This is the second installment of a three-part data snapshot series. Read the first part, Introducing CSET’s Patent Clusters.

The National Institutes of Health (NIH) is the largest worldwide public funder of biomedical research. NIH-supported research has impacted a wide-ranging array of human health issues, from its role in developing the first artificial heart valves to identifying and screening for cancer-associated genetic mutations.

Direct research funding, however, is only one part of the story. The NIH’s true reach is likely much broader through activities like pioneering the development of new research tools, supporting foundational research for follow-on innovation, and setting research goals and priorities.

We used CSET’s Map of Science and new Patent Clusters to better understand the impact of NIH-funded projects on the innovation pipeline. This analysis draws on RePORTER, a publicly available repository of NIH research grants and their associated outcomes, including both research publications and patents. Then, we evaluated how NIH-funded publications and patents are distributed throughout the broader research and commercialization landscape.

Key Takeaways:

- NIH-funded research comprises only 1% of published scientific articles, but is linked to half of the research landscape. Topics of NIH focus, like medicine, biology, and chemistry, are especially impacted.

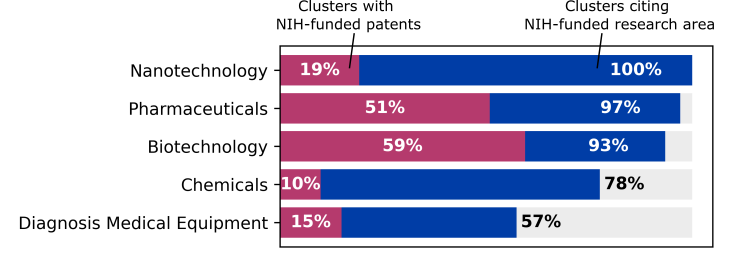

- While only 0.04% of the world’s patents are directly funded by the NIH, the agency’s reach is more widespread: the patents it funds show up in 4% of the patent fields and subfields that comprise what we call the “global patent landscape.” Its impact is particularly large in research areas like pharmaceuticals and biotechnology, where NIH-funded patents are present in 51% and 59% of those areas’ respective subfields.

- NIH-funded research supports downstream patenting. Over 39% of the subfields in our global patent landscape cite research areas that contain NIH-funded research publications—jumping to 97% of pharmaceutical subfields and 93% of biotechnology subfields.

- The NIH-funded research and innovation landscape creates a prosperous ecosystem that benefits the development of profitable blockbuster drugs, like the GLP-1 agonist Ozempic, without needing to directly fund them.

NIH-funded research supports downstream patenting. Over 39% of the subfields in our global patent landscape cite research areas that contain NIH-funded research publications, jumping to 97% of pharmaceutical subfields and 93% of biotechnology subfields.

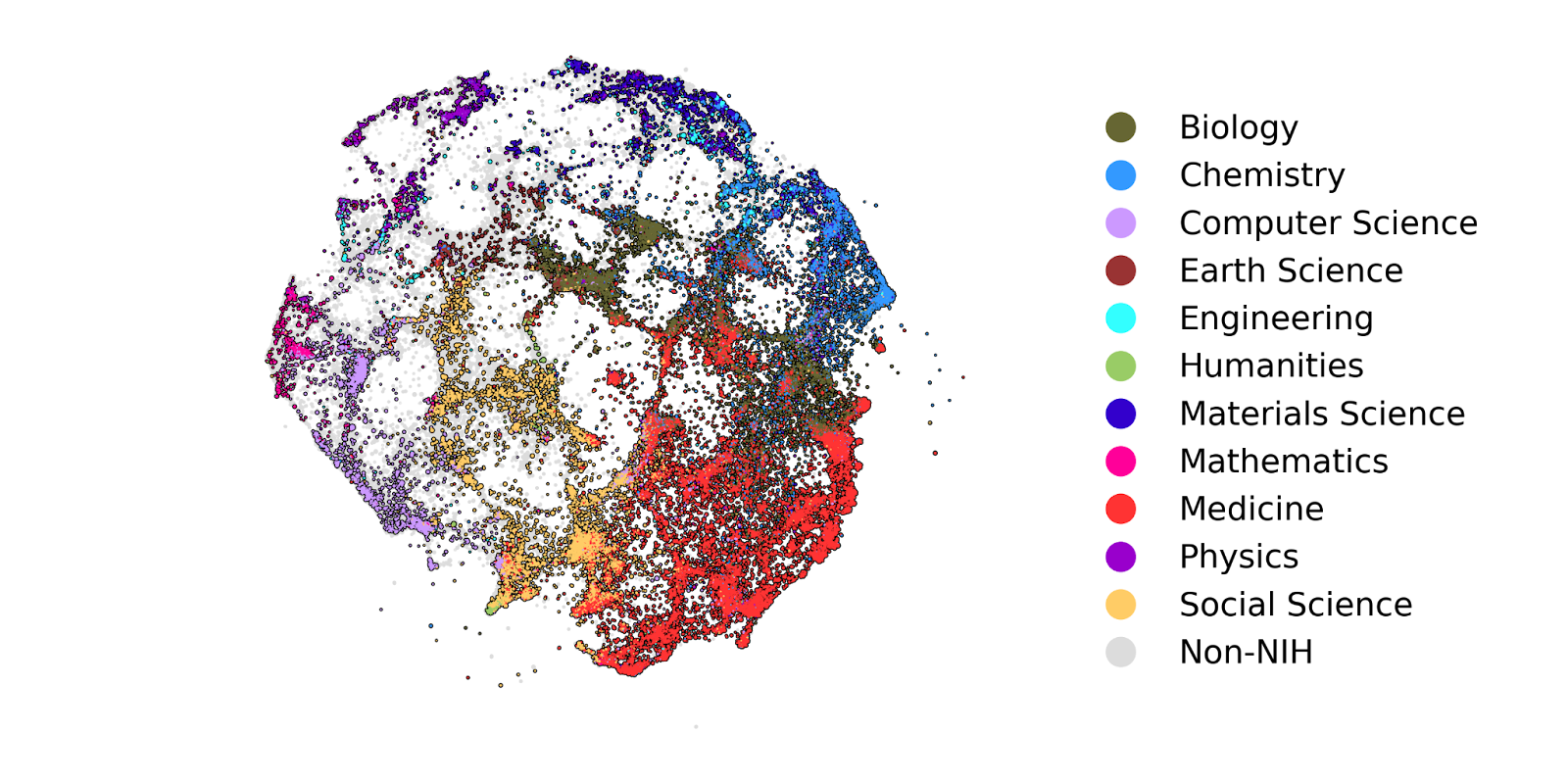

In total, the RePORTER database includes over 3 million scientific research articles from 1980-2024 resulting from NIH-funded projects, representing 1% of the 274 million papers in CSET’s Merged Academic Corpus of global scientific works. This reach grows when we map the NIH-funded publications to their corresponding research clusters in our Map of Science. Research clusters are groups of articles that cite each other often, acknowledging the way that new research discoveries influence and build upon each other. The NIH-funded research publications are distributed across 44,000 research clusters, representing approximately half of the clusters in the Map of Science. Figure 1 highlights the research clusters that contain NIH-funded publications, colored by scientific discipline.

Figure 1: Areas in CSET’s Map of Science Containing NIH-Funded Research

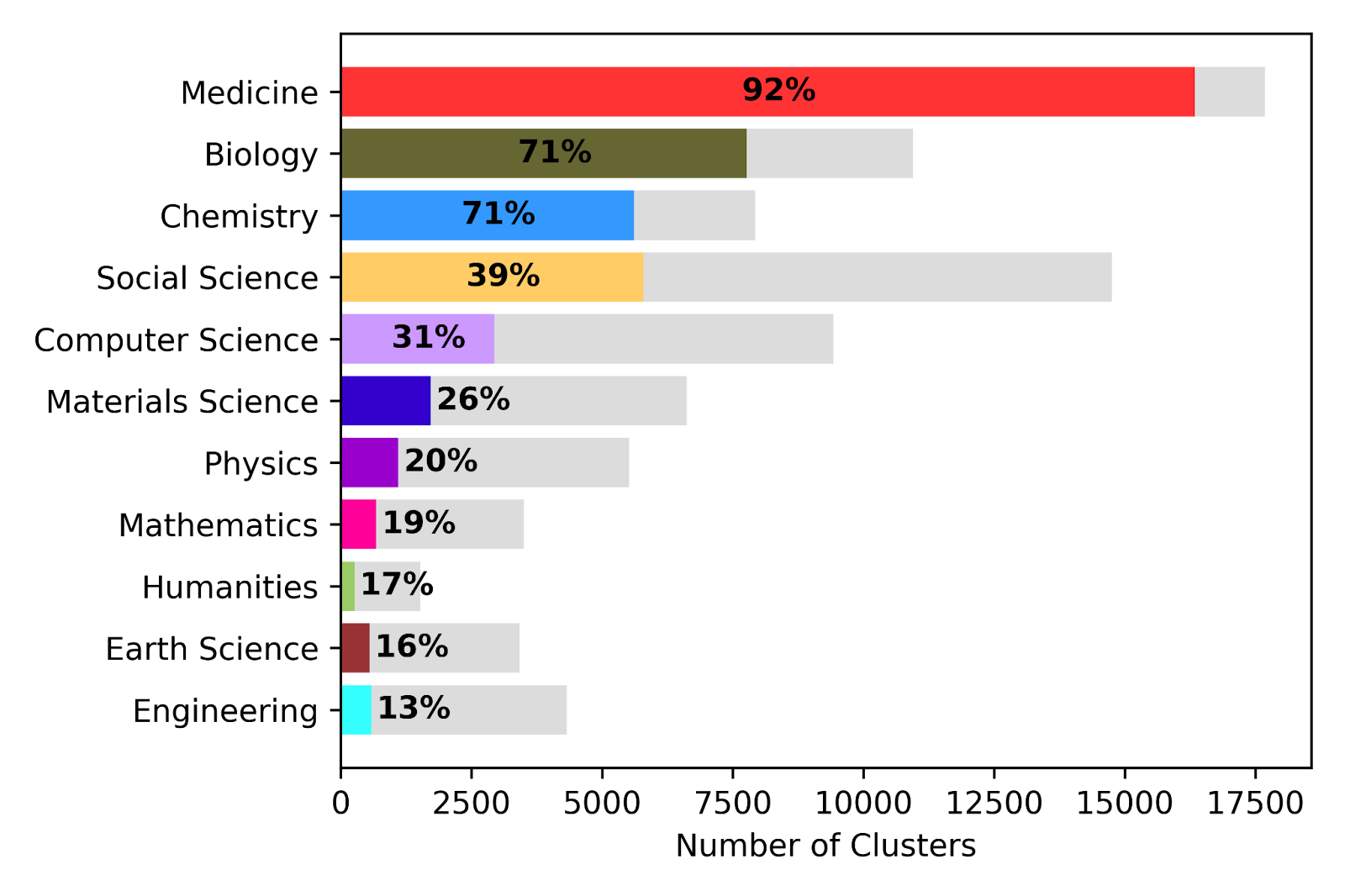

While NIH-funded publications are included in all 11 of the Map of Science’s scientific disciplines, they appear especially frequently in clusters related to the NIH’s life sciences portfolio: 92% of clusters related to medicine, 71% of clusters related to biology, and 71% of clusters related to chemistry contain NIH-funded publications.

Figure 2: Breakdown of Research Clusters Containing Funding by the NIH

Colored areas represent clusters containing NIH-funded publications, and gray areas represent clusters without NIH-funded publications.

In addition to research publications, we also assessed the distribution of NIH-funded patents across our Patent Clusters.

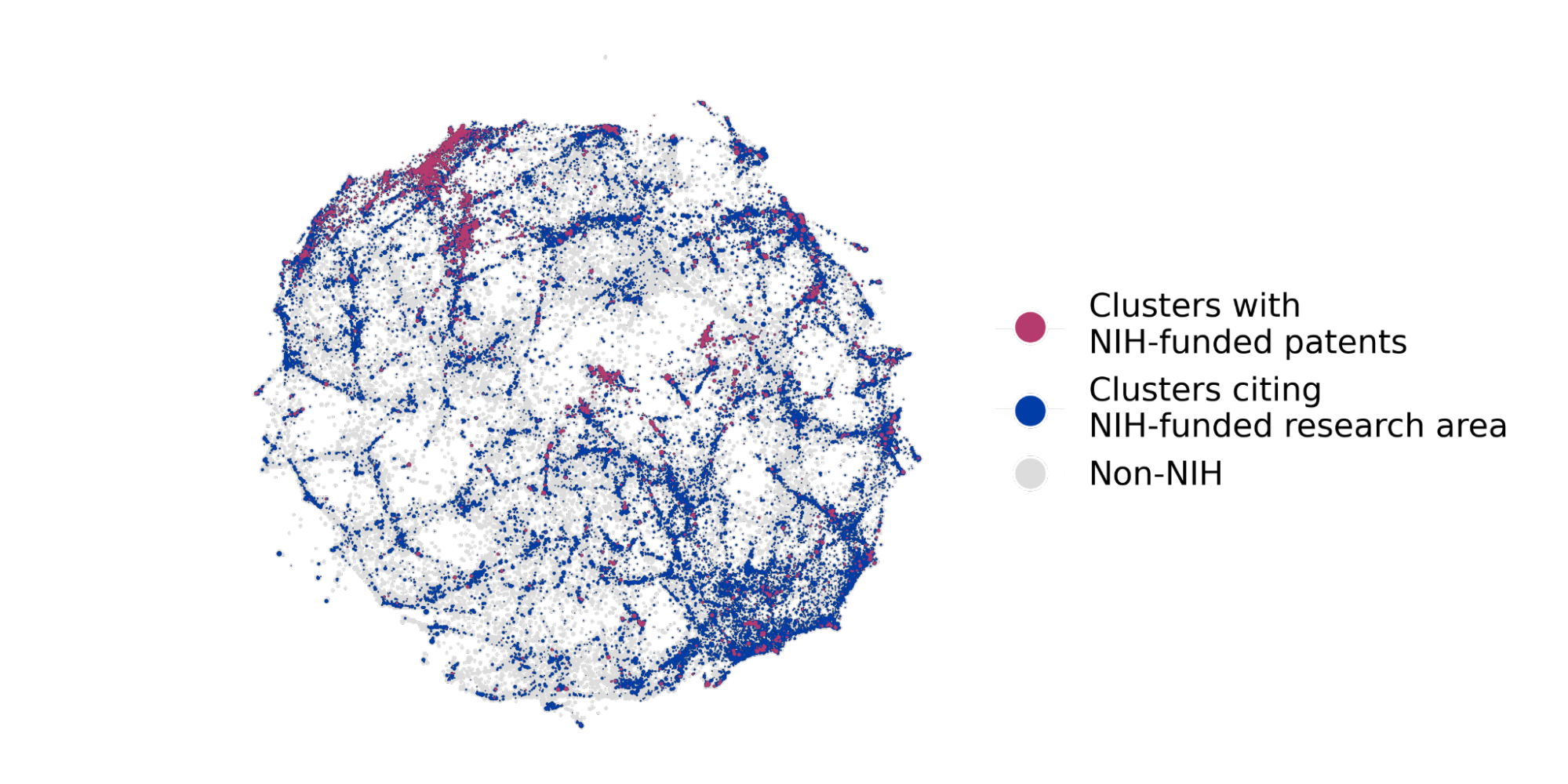

NIH funding has directly resulted in over 84,000 U.S. patents—that is, patents attributed to a specific grant in the RePORTER database. Because multiple patent documents can be filed for the same intellectual property, say at different stages in the patenting process, to add addendums, or to file in a different jurisdiction, CSET’s patent dataset aggregates all patents for the same IP into a single patent family. NIH-funded patents contribute to over 33,000 patent families distributed across about 4,700 patent clusters, representing 4% of the global patent landscape (Figure 3, “Clusters with NIH-funded patents”).

NIH funding has directly resulted in over 84,000 U.S. patents.

An important feature of patents is that many cite scientific articles, allowing for inferences about scientific diffusion from research to the innovation space. However, patent-to-publication citations can be sparse, in that not all patents include citations to scientific articles. It is therefore helpful to aggregate up and see areas of innovation which draw upon areas of research, evaluating citations between patent clusters and research clusters. The overall proportion of patent clusters that include patent citations to NIH-funded research clusters is 39% (Figure 3, “Clusters citing NIH-funded research area”).

Figure 3: Areas of Innovation in CSET’s Patent Clusters Impacted by NIH Funding

The impacts of the NIH on patents, either through direct funding or by funding research in areas cited by patents, are dispersed across the patent landscape. However, they are especially prevalent in pharmaceuticals and biotechnology. Nearly all pharmaceutical patent clusters (97%) and biotechnology clusters (93%) meet our broader definition of NIH impact by citing research clusters with NIH funding (Figure 4, blue bar). Over half of the clusters in each category contain patents directly funded by the NIH (Figure 4, mauve bar).

Figure 4: Topic Breakdown of Patent Clusters Impacted by the NIH

Within the pharmaceuticals and biotechnology categories, patent clusters that receive direct NIH funding span a diverse range of applications and use cases. We reviewed the patent clusters from each category with the highest proportion of NIH-funded patent families to get a sense of the types of technologies this funding supports. A few select examples include:

- Pharmaceutical Cluster 103504 includes patents that share a common goal of reducing antibiotic resistance in bacteria. (17% of patent families in this cluster contain NIH funding).

- Biotechnology Cluster 45028 relates to treating various types of cancer by targeting proteins involved in cell cycle regulation with peptide compounds and gene therapies. (15% of patent families in this cluster contain NIH funding)

- Pharmaceutical Cluster 76090 describes modifying peptide-like molecules through covalent “stapling” or cross-linking into ring-like structures as potential new cancer therapies and treatments for antibiotic-resistant bacteria. (14% of patent families in this cluster contain NIH funding)

- Biotechnology Cluster 69307 describes methods to develop, identify, and produce antibodies that bind to membrane receptors as potential therapies for cardiovascular disease and cancer. (12% of patent families in this cluster contain NIH funding)

Case Study: GLP-1 Agonists

Research and patents contribute not only to academic innovations, but also to economic ones. A class of drugs called GLP-1 agonists demonstrates the impact that research progress can have on global markets. These drugs were originally approved to help manage Type 2 diabetes, but have since become popular to aid in weight loss. Now, multiple name-brand formulations of GLP-1 agonists are considered “blockbuster drugs,” a term for pharmaceutical products that generate over $1B in sales annually. In fact, the combined worldwide sales for leading semaglutide and tirzepatide products Ozempic, Wegovy, Mounjaro, and Zepbound exceeded $41B in sales in 2024 alone.

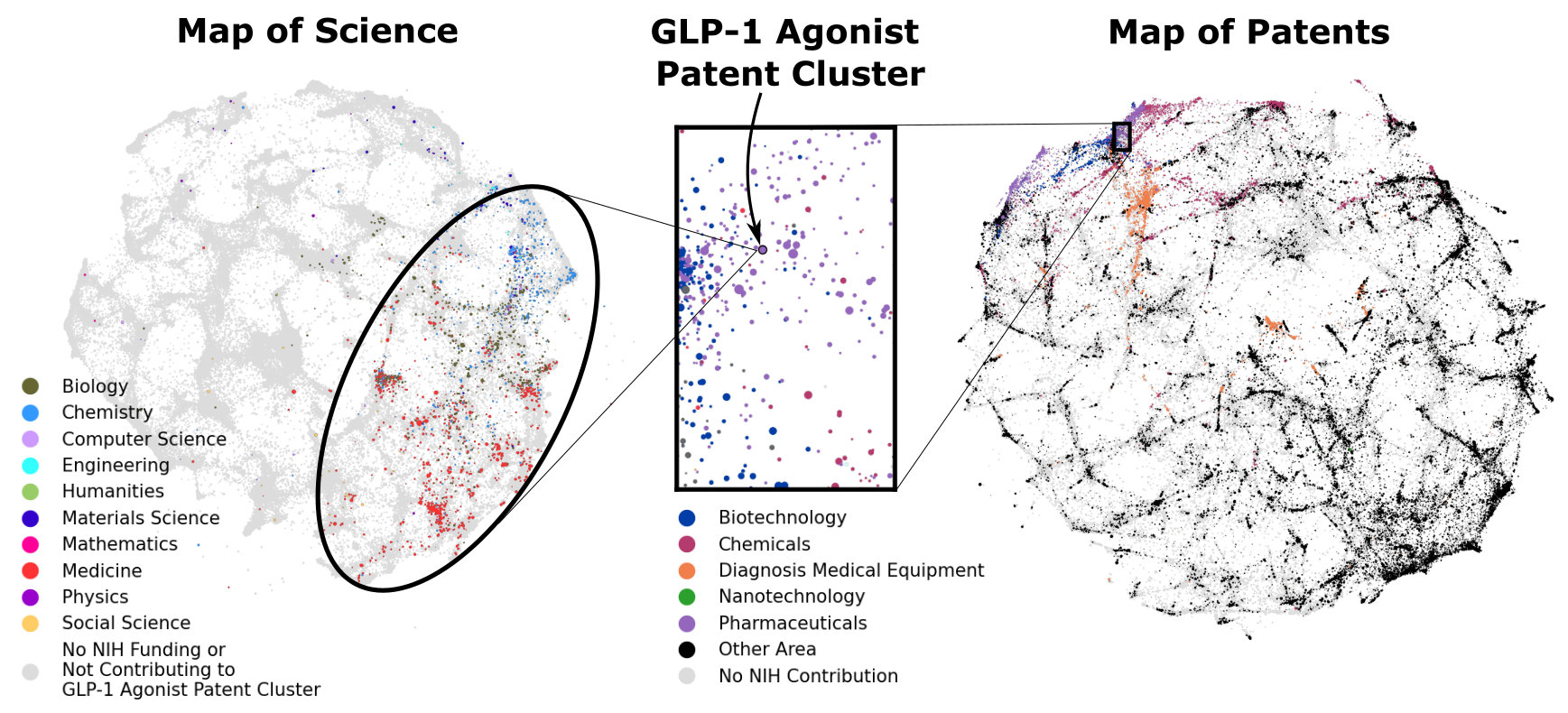

The active ingredients in GLP-1 agonist drugs are all located in the same patent cluster, numbered 2081 in our Map of Patents (shown in Figure 5). None of the aforementioned drugs themselves contain NIH-funded patents. However, 22 of the 2,818 patent families in their cluster received NIH funding, and the cluster is in close proximity to other clusters with NIH-funded patents (Figure 3, center box). Moreover, the GLP-1 agonist patent cluster draws on research from 2,405 research clusters, 96% of which contain NIH-funded research. Although the most famous GLP-1 drugs are not NIH-funded, the NIH contributed to the fundamental research ecosystem that fueled the development of these blockbuster drugs.

Figure 5: GLP-1 Agonist Patent Cluster and Scientific Research Connections