Federal Register Document Citation: Docket No. 250924-0161

Reference Number: XRIN 0694-XC138

Agency Name: Bureau of Industry and Security, Office of Strategic Industries and Economic Security, U.S. Department of Commerce.

Organization: Center for Security and Emerging Technology (CSET), Georgetown University

Primary POCs: Igor Mikolic-Torreira, Danny Hague

The Center for Security and Emerging Technology (CSET) at Georgetown University offers the following comments in response to the Bureau of Industry and Security, Office of Strategic Industries and Economic Security, U.S. Department of Commerce’s request for comments on Section 232 National Security Investigation of Imports of Robotics and Industrial Machinery. A policy research organization within Georgetown University’s Walsh School of Foreign Service, CSET provides decision-makers with data-driven analysis on the security implications of emerging technologies, focusing on artificial intelligence, advanced computing, and biotechnology. We appreciate the opportunity to offer these comments.

This document is approved for public dissemination. The document contains no business-proprietary or confidential information. Document contents may be reused by the government in developing the Section 232 National Security Investigation of Imports of Robotics and Industrial Machinery and associated documents without attribution.

Overview

Georgetown University’s Center for Security and Emerging Technology (CSET) presents the following responses to the BIS RFC regarding the Section 232 Investigation on Imports of Robotics and Industrial Machinery. These facts and observations are drawn from CSET’s wide body of research and a forthcoming article examining AI-Robotics convergence and the underlying supply chain supporting robotics. CSET notes that, while the investigation also requests information about industrial machinery (to include CNC machines, metalworking equipment, EDM machinery, and laser and water-cutting machinery), its research has focused more on the robotics supply chain and as a result the comments below are limited to robotics topics and respond to specific information elicitations where CSET research is responsive.

- The current, projected, and optimal demand for robotics and industrial machinery, and their parts and components in the United States;

The leading international robotics association defines a robot as “an actuated mechanism programmable in two or more axes with a degree of autonomy, moving within its environment, to perform intended tasks.”1 Helpfully, it also explains specifically what they do not consider a robot: software, drones, voice assistants, autonomous cars, ATMs, and smart washing machines are not considered robots.2 Robots are often thought of as autonomous mobile robots (AMRs), manipulator arms or humanoids.3 There are dozens of other types of robots, including quadruped (dog-like) robots, medical robots (designed to assist with surgery, for example), and collaborative robots (or “cobots,”) that work with a human-in-the-loop, typically in industrial environments. In general, all robots typically consist of five core hardware systems:

- Structural components provide the physical framework, support, and protection for all other systems. For humanoid robots, as the name implies, these structural components are anthropomorphic and generally are designed to provide joint, weight distribution, movement, and manipulation that mimics human form.

- Actuation systems generate and control physical movement. For industrial robotics, these systems rely on precision motors that can operate repeatedly at high speeds, manipulating heavy loads. For humanoid robots, these systems can require more precision and less load-bearing ability.

- Power systems provide and distribute energy to all systems. Industrial robots are usually connected to a fixed power supply, while humanoid robots and AMRs rely on batteries.

- Computing systems process sensor data and control robot behavior, with humanoid robots having the most complex compute stack and industrial robots among the least compute-intensive.

- Sensor systems perceive the environment in which the robot operates as well as its internal state and include cameras, sensors for depth perception, torque/force, joint position, and LiDAR.

Estimating current, projected, and optimal demand for robots and their components is nearly impossible due a lack of a standardized bill of materials (Figure 1) as well as a lack of robust, comprehensive, high-fidelity supply chain data. There are a variety of reasons this data does not exist: most robotics transactions are B2B and private companies do not feel a need to share public statistics on their current or future rate of robotic adoption nor their BOMs. Additionally, most robotics development is still very nascent (especially in the humanoid sub-market). Thus demand estimates are inherently speculative, and it is unclear if/when commercial adoption at scale will occur.

Figure 1. Hardware Bill of Materials for Three Types of Physical AI-powered Robots

| Humanoid Robot | Industrial Robot | Autonomous Mobile Robot | |

| Example | |||

| Physical Structure | Full-body frame with ~20-30 degrees of freedom Anthropomorphic proportions and joint designs Lightweight materials (carbon fiber, aluminum alloys) | Heavy-duty fixed base Rigid arm links (4-7 segments) Industrial steel, aluminum) | Wheeled base platform Payload structure Protective bumpers/housing |

| Actuators | 20-30+ high-performance electric motors/actuators Custom gearboxes with high torque density Specialized joint mechanisms (series elastic, direct drive) | 6-7 high-precision servo motors Industrial gearboxes Braking systems | 2-4 drive motors with wheels Optional lift mechanism |

| Power | High-density battery packs (2-4 kWh typical) Power distribution system Thermal management system | Fixed power supply (typically no battery) Electrical cabinet | Battery pack (1-3 kWh typical) Charging interface |

| Compute | High-performance onboard computer (often multiple) GPU/TPU for AI inference Multiple microcontrollers for low-level control | Industrial controller Safety PLC Teach pendant interface | Navigation computer Motor controllers Fleet management interface |

| Sensors | Stereo/depth cameras (2-4) Force/torque sensors at key joints IMUs for balance Tactile sensors for hands/grippers Microphones for audio input | Encoders at each joint Limited external sensing Optional vision system for guidance | LiDAR for navigation (1-2 units) Cameras for object detection Proximity sensors Wheel encoders |

| Cost Range | $50-$500k | $20-150k | $15-80k |

The worldwide AI Robotics market is valued at $20-$23 billion in 2025.4 In the next ~10 year period however industry analysts expect this market will reach, or exceed, $100 billion in value.5 Analysts at Goldman Sachs recently forecast that the total addressable market specifically for humanoid robots will grow from $6 billion today to $38 billion in 2035, while analysts at Morgan Stanley are even more optimistic, asserting the market will reach $5 trillion by 2050.6

These market numbers are speculative and lack definitional clarity. The “AI Robotics market” is poorly defined and can refer to everything from autonomous mobile robots like those currently in use by Amazon to the industrial robots used by automotive manufacturers. Scalable manufacturing of humanoid robots faces myriad technical obstacles, some of which were discussed above. Much of this markets’ forecast growth is contingent on unit costs going down as manufacturing economies of scale are achieved (“the robots start to build robots”) and performance/reliability increases dramatically as hardware and software improves. These breakthroughs are by no means guaranteed. Additionally, numbers cited by analysts and firms lack clarity and cannot be independently verified. Some companies consider warehouse robots a form of industrial robots and report numbers accordingly. Others maintain different definitions, leading to over (or under) counting total deployment numbers. Relatedly, the numbers that are reported by firms are often speculative and it is difficult to determine the validity of the claims without genuine on-the-ground investigation. For example, in 2011 Foxconn announced a program to deploy 1 million robots in its factories by 2014.7 By 2016 it had only managed to deploy 40,000 and more recent numbers are lacking.8 Similarly, companies like Siemens (Germany) and JD.com (China) have announced the creation of “dark” factories that are fully automated and can function without human intervention, but it is unclear how robot-dense these facilities are, if they are comparable, and by what metrics to compare them.

- The role of foreign supply chains, particularly of major exporters, in meeting United States demand for robotics and industrial machinery, and their parts and components;

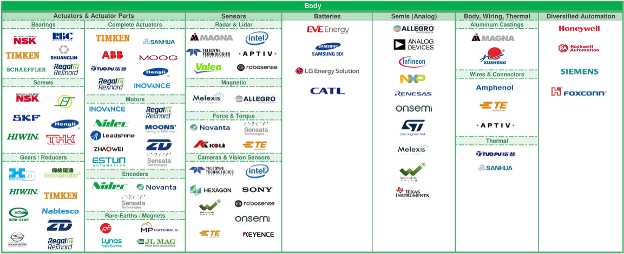

The robotics hardware components ecosystem, especially the ecosystem of suppliers that can deliver components at-scale cost-competitively (Figure 2), is largely controlled by firms in Asia and Europe. Several recent reports cover this market in detail.9 This section summarizes these reports, focusing specifically on firms that control one or more chokepoint technology that could help or hinder AI-robotics convergence. There is no one country with a vertically integrated robotics supply chain, and interdependence is high. Robotics-specific hardware demand is rarely sufficient for firms to establish a business line, meaning nearly all suppliers serve multiple end use markets (ex. automotive, aerospace). Japanese and German component suppliers maintain notable market share, though there are also competitive suppliers in the U.S., Europe, and China. This supply chain has many “hidden giants” that control one or more key part of the market as well as COTS suppliers who offer best-in-class products. In both cases, suppliers rarely produce products solely for the robotics end use market, though they will optimize products for specific use cases if demand is sufficient.10

In the former category, Japanese firms like Harmonic Drive Systems, Nabtesco, Nidec, and Sumitomo Heavy Industries offer precision mechanical gears, motors, and actuators that facilitate robotic joint movements and maintain high market share worldwide.11 Notably, Harmonic Drive Systems controls 80% of the market for the precision gears it produces.12 In Europe, German firms like Bosch Rexroth Festo, SEW-Eurodrive, SCHUNK, and Schmalz offer robotics components for “end effectors” (gripping), motors, and actuators.13 German firms are particularly competitive in the supply of end-effectors (for dexterous manipulation), a key technical challenge that has yet to be fully addressed for humanoid adoption.14

In the latter category, many firms offer commercial off the shelf products at competitive prices with performance characteristics that make them suitable for robotics applications. For many robotics manufacturers, access to CATL’s (China) batteries, Sony’s (Japan) cameras, and NXP’s (Netherlands) microcontrollers are sufficient. This reliance on COTS parts comes with tradeoffs however. Each robotics company is cobbling together their own unique bill of materials, meaning suppliers cannot rely on large orders necessarily. If demand shifts in their core markets (ex. aerospace), they are likely to prioritize production volume for these customers at the expense of the high mix, low volume components required by robot manufactures. In addition to this economic challenge, these COTS hardware solutions are frequently “good enough,” but not necessarily technically optimal. Hardware optimized for robotics applications is costly to develop and difficult to scale. And, once integrated in to actual robots, characterizing why the hardware failed (fatigue, environment, tolerance) makes for a slow and expensive cycle of iteration. Other industries have accelerated these cycles of “down time” by creating service and support businesses, but that generally does not yet exist in robotics at scale.

Figure 2. Humanoid Robot Component Suppliers (Publicly Traded)

The robot manufacturing landscape features startups as well as established industry leaders spread across several key countries. This section focuses specifically on relative national competitiveness in three types of robots that are seeing the greatest interest in Physical AI integration: humanoid robots, industrial robots, and autonomous mobile robots. The humanoid robotics manufacturing landscape is diverse, with at least 38 companies developing 47 different robots listed as under development according to one source.15 There are no “incumbent” humanoid manufacturers today (unlike other robotics sub-markets) and all the firms mentioned below, with the exception of Boston Dynamics, entered the market in the last 5-10 years. The largest and most well-funded U.S.-based humanoid developers of humanoid robots include Boston Dynamics16 Atlas), Tesla (Optimus), Agility Robotics (Digit), Apptronik (Apollo) and Figure AI (Figure 02). China has at least twice as many firms as the U.S. pursuing humanoid robotics development, including Unitree (H1 and G1 models), UBTECH (Walker series), Xiaomi (CyberOne), EngineAI (PM01), and Fourier (GR-1). Outside of the U.S. and China there are also firms in Japan (Kawasaki), South Korea (Rainbow Robotics), and Canada (Sanctuary AI) with at least one humanoid in development. Industrial robotics continues to be dominated by the so-called “Big Four”: ABB (Switzerland), FANUC and Yaskawa (Japan), and KUKA (Germany, now China).17 While these four firms are estimated to control 75% of the global market for industrial robots, there are also notable suppliers in Europe (Comau and Staubli) and Japan (Epson, Kawasaki, Mitsubishi).18 China has several publicly traded industrial robot manufactures including Siasun Robotics, Efort [sic], and Etsun Automation.19

At the same time, the warehouse robotics market continues to grow worldwide at a scale and speed that exceeds other industry adoption. Amazon, which acquired Kiva Systems in 2012 to enter the warehouse robotics market, reports having one million autonomous mobile robots in its factories.20 These robots consist of everything from AMRs capable of moving pallets around a warehouse to “pick and place” arm-like robots that can sort boxes for transport. Other notable suppliers include Geek+ (China), Daifuku (Japan), EK Robotics (Germany), and Balyo (France, publicly-traded by majority-owned by SoftBank (Japan)).21 Finally, specialized robotics applications for hospital and medical environments are also seeing increased development. In the U.S., firms such as Intuitive Surgical with its da Vinci system have been commercializing human-in-the-loop surgical robots, while in China firms like Fourier are manufacturing robots for medical rehabilitation.22

- The impact of the use or lack of use of robotics and industrial machinery on U.S. manufacturing employment;

While humanoid robots get the headlines, the actual deployment numbers by volume are dominated by industrial robots and, interestingly, the leading deployer of robots per capita is a country not mentioned to this point: South Korea.23 Robots are most frequently installed by automotive, aerospace, electronics, and food manufacturing OEMs.

The industrial robotics sector remains the most mature segment of the robot market, with automotive manufacturing still leading global deployment. This is true in the U.S. (Figure 3) as well as Europe and Asia. Japan’s Toyota and Germany’s Volkswagen Group consistently rank among the highest-density robot users, while South Korea maintains the world’s highest robot density at 1,000 industrial robots per 10,000 manufacturing employees (with Singapore coming in second).24 China has rapidly emerged as the largest overall market by volume, installing nearly 290,000 industrial robots annually—more than Japan, the U.S., South Korea, and Germany combined.25 These same trends of adoption are true for AMRs as well, with the U.S. and Europe leading in installations to date, while Chinese firms see the highest growth rate in installations in recent years.

The humanoid robotics sector remains largely in the experimental phase, with total shipments in the hundreds compared with the hundreds of thousands of industrial robots and AMRs mentioned above. Japan leads in research and development, with Honda’s ASIMO pioneering the field and newer platforms from SoftBank Robotics gaining traction in customer service roles. Hospitals in Japan have been early adopters of humanoid assistants for patient monitoring and basic care tasks. In Europe, automotive manufacturers including BMW and Audi are piloting limited humanoid robot deployments for specific assembly tasks. Figure AI, the U.S. developer of humanoid robots, announced a successful test with BMW in 2024.26 China has made humanoid robotics a national priority, with companies like UBTECH deploying service robots in retail, hospitality, and healthcare settings. Despite the attention humanoids receive, they currently represent a small fraction (likely less than 1%) of the total robotics market by revenue.

(xiv) any other relevant factors.

The policy agenda around robotics is immature compared to other emerging technologies like semiconductors, AI, and quantum, where substantial research has mapped the key players, their comparative advantages, chokepoints, and supply chains. The robotics supply chain also lacks robust datasets that provide signals on supply, demand, production, consumption, and the intensity of robotics adoption (by country, by industry, by factory). As a result, the few data providers today such as IFR and financial analyst reports play a disproportionate role in shaping discourse. There is a need for a policy research agenda that develops mature analysis to cut through the hype, identify genuine advances, and characterize the potential depth of robotics adoption across economies.

Finally, from a national security perspective, a research agenda to address the gap between physical intelligence and dexterous intelligence is critical. This gap is particularly problematic in the aerospace and defense sectors, where high mix, low volume manufacturing lines necessitate regular re-tooling and adoption of automated solutions is more difficult. Physical intelligence (spatial awareness for pick, move, and place-capable robots) is not enough in environments that require dexterous intelligence (insertion, threading, force feedback). Policies that address (in particular) the acute lack of quality tactile sensors, kinematics, and real-world data would facilitate the development and adoption of robotics in these key sectors.

- https://www.iso.org/obp/ui/#iso:std:iso:8373:ed-2:v1:en. The IFR also explicitly states what a robot is not: software, drones, voice assistants, autonomous cars, nor ATMS, smart washing machines etc. https://ifr.org/img/worldrobotics/Press_Conference_2024.pdf (5).

- There is room for disagreement about constitutes a robot based upon this definition, but for the sake of accurately representing the data IFR collects, this paper uses the IFR definition when referring to statistics on robotics adoption cited in subsequent sections.

- https://blogs.nvidia.com/blog/three-computers-robotics/

- https://www.statista.com/outlook/tmo/artificial-intelligence/ai-robotics/worldwide; https://www.globenewswire.com/news-release/2024/10/22/2967253/0/en/Artificial-Intelligence-Robots-Market-Size-to-Worth-USD-124-26-Bn-by-2034.html; https://www.roboticstomorrow.com/story/2024/08/ai-robots-transforming-industries-with-smart-robotic-solutions/23005/

- https://www.statista.com/outlook/tmo/artificial-intelligence/ai-robotics/worldwide; https://www.globenewswire.com/news-release/2024/10/22/2967253/0/en/Artificial-Intelligence-Robots-Market-Size-to-Worth-USD-124-26-Bn-by-2034.html; https://www.roboticstomorrow.com/story/2024/08/ai-robots-transforming-industries-with-smart-robotic-solutions/23005/

- https://www.goldmansachs.com/pdfs/insights/pages/gs-research/global-automation-humanoid-robot-the-ai-accelerant/report.pdf (1); https://www.cnbc.com/2025/04/29/how-to-play-a-5-trillion-market-for-humanoid-robots-by-2050.html

- [1] https://www.reuters.com/article/technology/foxconn-to-rely-more-on-robots-could-use-1-million-in-3-years-idUSTRE77016B/;

- https://www.nextbigfuture.com/2016/10/foxconn-reaches-40000-robots-of.html

- For example: https://www.uscc.gov/sites/default/files/2025-02/Sunny_Cheung_Testimony.pdf

- For example, ST Micro will not create an entirely new chip architecture for robotics users, but it will tweak existing products for robotics use cases: https://www.therobotreport.com/stmicroelectronics-boosts-ai-edge-npu-accelerated-microcontroller/.

- https://asianroboticsreview.com/home224-html

- https://www.uscc.gov/sites/default/files/2025-02/Sunny_Cheung_Testimony.pdf (70)

- https://www.mobile-robots.com/manufacturer/sew-eurodrive/; https://www.automationworld.com/home/company/13321766/festo-corporation; https://www.boschrexroth.com/en/de/industrial-automation/; https://www.marketsandmarkets.com/Market-Reports/robot-end-effector-market-251736819.html

- https://www.marketsandmarkets.com/Market-Reports/robot-end-effector-market-251736819.html; https://www.construction-physics.com/p/robot-dexterity-still-seems-hard

- https://humanoid.guide/

- Note: now owned by Hyundai (South Korea), though its operations remain in the U.S.

- https://standardbots.com/blog/robots-for-manufacturers-a-guide#:~:text=Who%20are%20the%20big%20four,bigger%20isn’t%20always%20better.; https://semianalysis.com/2025/03/11/america-is-missing-the-new-labor-economy-robotics-part-1/#historical-robotics-and-how-the-current-powers-came-to-be

- https://www.automate.org/robotics/news/10-industrial-robot-companies-that-lead-the-industry

- https://asianroboticsreview.com/home414-html

- https://finance.yahoo.com/news/amazon-grows-over-750-000-153000967.html; https://www.aboutamazon.com/news/operations/amazon-million-robots-ai-foundation-model

- https://www.therobotreport.com/softbank-makes-offer-to-acquire-balyo-shares/; https://www.marketsandmarkets.com/Market-Reports/autonomous-mobile-robots-market-107280537.html; https://www.thewirechina.com/2024/06/02/geeking-out-over-warehouse-robots-chinese-company-geekplus/; https://finance.yahoo.com/quote/BALYO.PA/?guccounter=1

- https://www.china-briefing.com/news/chinese-humanoid-robot-market-opportunities/; https://www.intuitive.com/en-us/patients/da-vinci-robotic-surgery

- The reason for South Korea’s leading position in robotics adoption stems from several factors: a major push for automation from OEMs seeking productivity gains, interest/first-mover advantages from the chaebol’s beginning decades ago, and government policies to encourage robotics development/adoption as a means of mitigating rapid population aging + persistently low birth rates. https://manufacturing-today.com/news/one-in-ten-workers-in-south-korea-is-a-robot/.

- https://patentpc.com/blog/top-countries-automating-fastest-global-robotics-map

- https://ifr.org/img/worldrobotics/Press_Conference_2024.pdf, (17, 18)

- https://www.press.bmwgroup.com/global/article/detail/T0444265EN/successful-test-of-humanoid-robots-at-bmw-group-plant-spartanburg?language=en