This is the third installment of a three-part data snapshot series. Read Part 1, Introducing CSET’s Patent Clusters, and Part 2, The NIH’s Impact on Research and Innovation.

Measuring the impact of AI through legally protected innovations and commercialization is critical for understanding how, where, and by whom AI is being adopted. Patent clusters offer insight into this aspect of AI diffusion by allowing for the identification of AI-relevant patent families and the clusters where they appear most frequently. The data for identifying AI relevance is drawn from CSET’s work in collaboration with 1790 Analytics on Patents and Artificial Intelligence.1

CSET’s Patent Clusters leverage a novel methodology to create a set of patent clusters through a multifeature network. This multifeature network records the relationships between patents through citation links, the textual similarity between patent titles and abstracts, and the textual similarity between the descriptive text of the patents’ Cooperative Patent Classification (CPC) and International Patent Classification (IPC) codes. Each patent cluster includes key information related to the patent inventors, owners, cited research publications, technology areas, and more.

AI Patent Landscape

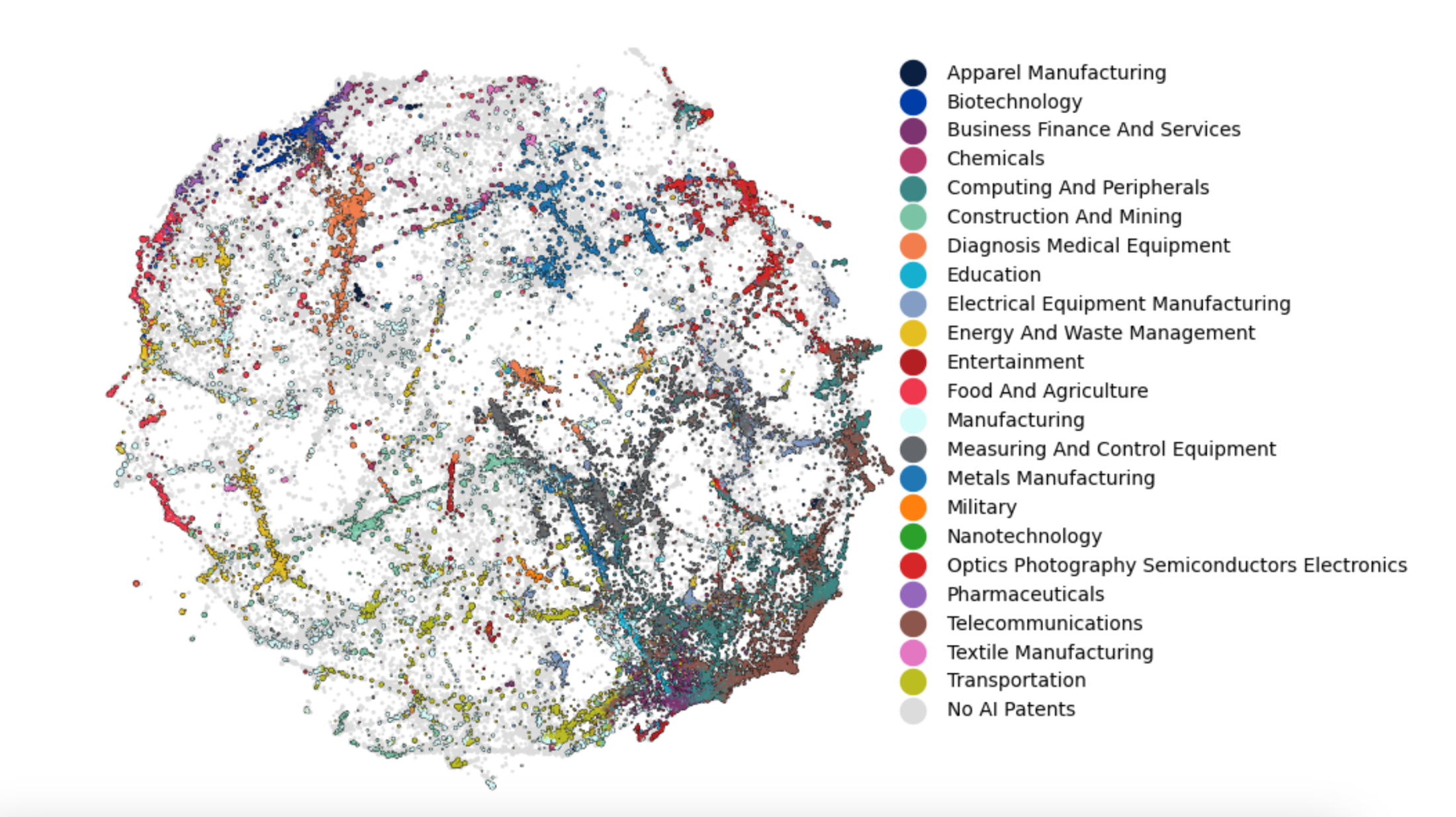

We start by identifying all patents that are AI relevant.2 In all, there are 30,841 patent clusters that contain AI patents, indicating that 26.5% of all patent clusters contain at least one AI patent. These span the full range of technology categories, as shown in Figure 1, where patent clusters are plotted and non-AI clusters are greyed out.

Patent categories are pulled from a broad taxonomy of 46 general categories and 22 technological categories and based on the International Standard Industrial Classification of All Economic Activities. We assign patents to these categories using patent family CPC and IPC codes. These categorical assignments represent topical divisions between patents and provide a basis for broadly characterizing clusters, despite their limited information for assignment.3

Figure 1: Patent Clusters in the Map of Patents with AI Patents

Source: CSET’s patent clusters and CSET’s patent categories

Next, we consider the composition of clusters. We look at the technology category breakdown for clusters with varying AI concentrations, shown in Figure 2. The concentration of AI patents in a patent cluster ranges from 0 to 5%—indicating a relatively small number of AI patents in that cluster—to 75 to 100%—indicating that all or nearly all patents in that cluster are AI-related. For clusters with no AI patents, we see many technology categories represented, with the largest percentage of non-AI patent clusters in manufacturing. As the percentage of patents in a cluster becomes increasingly AI, the share of computing clusters also increases. Clusters with fewer AI patents often represent areas of early AI application, whereas clusters with more AI patents are more mature AI applications. Alternatively, clusters with a lower concentration of AI patents may represent technologies for which AI offers one of numerous possible solutions to a given task, while those clusters with a higher concentration may focus on the mechanics of AI itself. The technology categories that appear to have incorporated AI to a greater extent include Diagnosis & Medical Equipment, Chemicals, and Telecommunications.

Figure 2: AI Concentration of Patent Clusters by Technology Category

Source: CSET’s patent clusters dataset

Table 1: Example Patent Clusters by AI Concentration

| AI Concentration | Example Patent Cluster |

|---|---|

| 0%–5% |

Cluster 56877 (Food and Agriculture) Includes patents that evaluate, modify, and edit specific genes in important crops—particularly soybeans, as well as Chinese cabbage, rice, and similar—to improve agricultural capabilities. This cluster contains 490 patents. Leading patent holders are Nanjing Agricultural University and Huazhong Agricultural University. |

| 5%–10% |

Cluster 16751 (Biotechnology) Includes methods to compress genome sequences and identify, represent, or search for relevant genetic sequences within genomes. This cluster contains 1,138 patents. Leading patent holders are IBM and Illumina. |

| 10%–25% |

Cluster 1207 (Diagnosis Medical Equipment) Describes methods and systems used for human fall detection and injury risk prevention. This cluster includes 3,424 patents. Leading patent holders are Philips and the Chinese Academy of Sciences. |

| 25%–50% |

Cluster 85553 (Measuring and Control Equipment) Describes devices and methods used to measure or predict the risk of leakage in well and gas drilling and provide early warning. This cluster contains 422 patents. Leading patent holders are China National Petroleum Corporation and Sinopec. |

| 50%–75% |

Cluster 3045 (Optics, Photography, Semiconductors, Electronics) Covers human lung image processing and segmentation, particularly for pulmonary nodule detection. This cluster includes 2,717 patents. Leading patent holders are Siemens and Northeastern University. |

| 75%–100% |

Cluster 909 (Computing and Peripherals) Focuses on neuromorphic computing hardware, including memristors, neuromorphic circuits, physical perceptrons, and similar units. This cluster contains 3,528 patent families. Leading patent holders are IBM and Qualcomm. |

This snapshot reveals how AI patents are distributed across different areas of innovation, and how interdisciplinary AI overlaps with industrial sectors and feeds new areas of growth. For more information, please reach out.

- For more details on 1790 Analytics, see “Data resources,” 1790 Analytics, https://1790analytics.com/#data.

- See https://github.com/georgetown-cset/1790-ai-patent-data for methodology.

- CSET patent categories are industry-based labels (e.g., manufacturing) for patents and patent families derived from patent classification codes. Categories are based on ISIC (International Standard Industrial Classification of All Economic Activities) codes.