As covered in the previous data snapshot, government procurement contracts play a critical role in connecting federal agencies with key services and technologies. Complete analysis of government procurement requires understanding each stage of the contract process. Several commercial entities tackle this problem to provide actionable intelligence into the government technology space. One such company is Govini, which CSET partnered with for an exploratory research project looking for subsets of artificial intelligence (AI)-related contracts.1 This data snapshot utilizes curated contract data from Govini’s Ark.ai platform to show how contract analysis provides insight into key emerging technologies.

Identifying all relevant contracts from U.S. government procurement data is challenging. Key technology areas often cut across industry classification codes, and require expert analysis to ensure their relevance to the research question at hand. This data snapshot focuses on a curated set of AI and machine learning (ML) and cloud computing platforms to illustrate how the U.S. government engages with industry through contracts, and how knowledge of industry players provides insight into the public sector’s adoption of key technology areas.

AI/ML Broadly

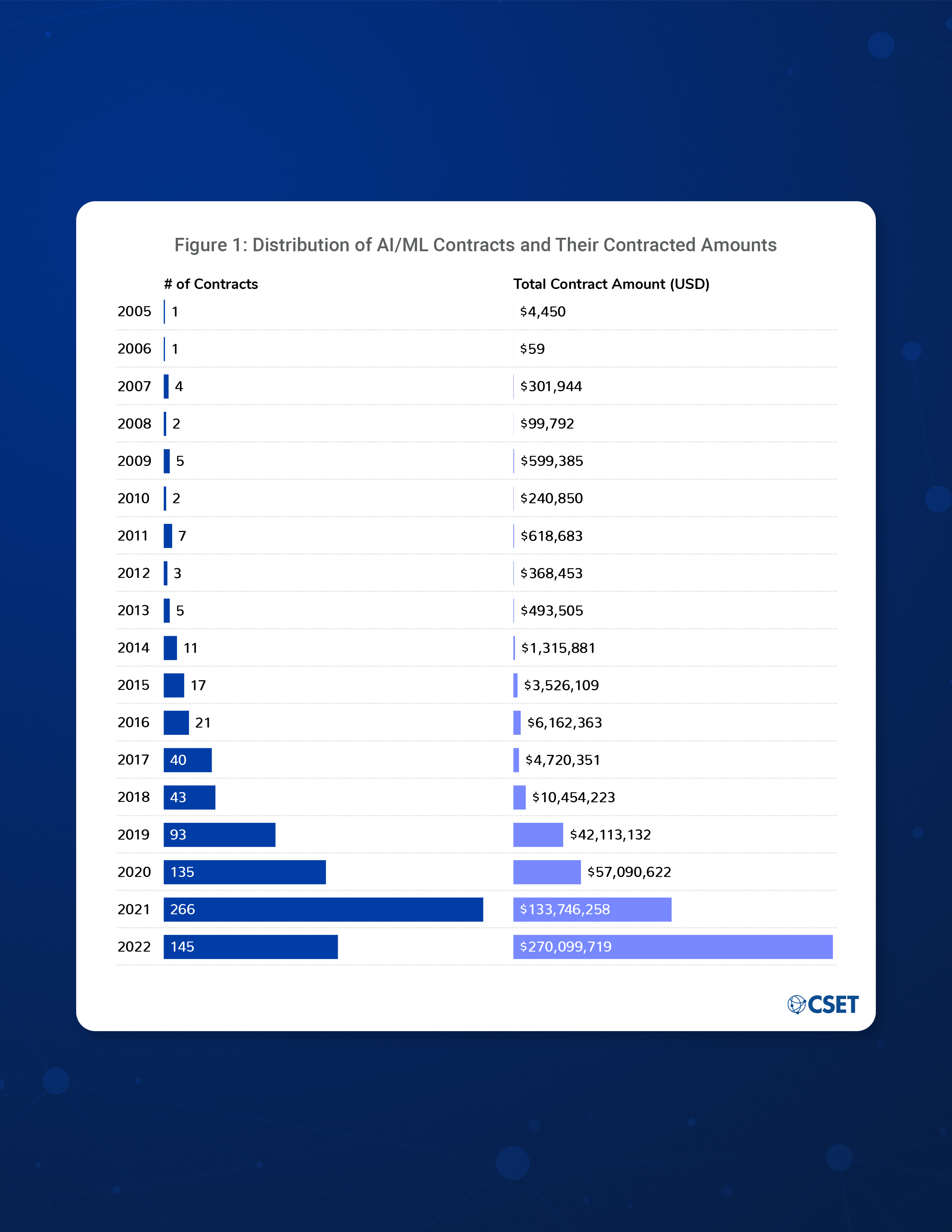

A majority of expertise in key emerging technologies lies outside of government. The procurement of emerging technologies signals the federal government’s interest, and can provide information about the companies providing these technologies and services. AI and ML systems represent such an area that can be tracked through the analysis of procurement data. In 2020, Executive Order 13960 required federal agencies to disclose “the criteria, format, and mechanisms for agency inventories of non-classified and non-sensitive use case of AI by agencies” This executive order conveys the importance of tracking AI/ML use cases within the public sector. Procurement data offers additional insight by tracking which industry players provide these AI/ML services, how much they receive, and how these contracts evolve over time. In our contracts dataset, compiled in collaboration with Govini, 806 contracts explicitly mention artificial intelligence or machine learning. Across all surfaced contracts, the federal government has spent $536,045,575 on these systems since 2005. This figure does not capture key transactions such as the procurement of analytic services where AI/ML comprises just one component or is not explicitly mentioned within the captured text fields. Therefore, this figure likely underrepresents AI/ML purchases by the federal government.

Figure 1: Distribution of AI/ML Contracts and Their Contracted Amounts

Federal interest in AI/ML has a long history within procurement data. However, activity has increased in the last five years. Of that $500 million, over half was spent in 2022 alone. While 2023 data is incomplete, we have already been able to surface five such AI/ML contracts for the current year.

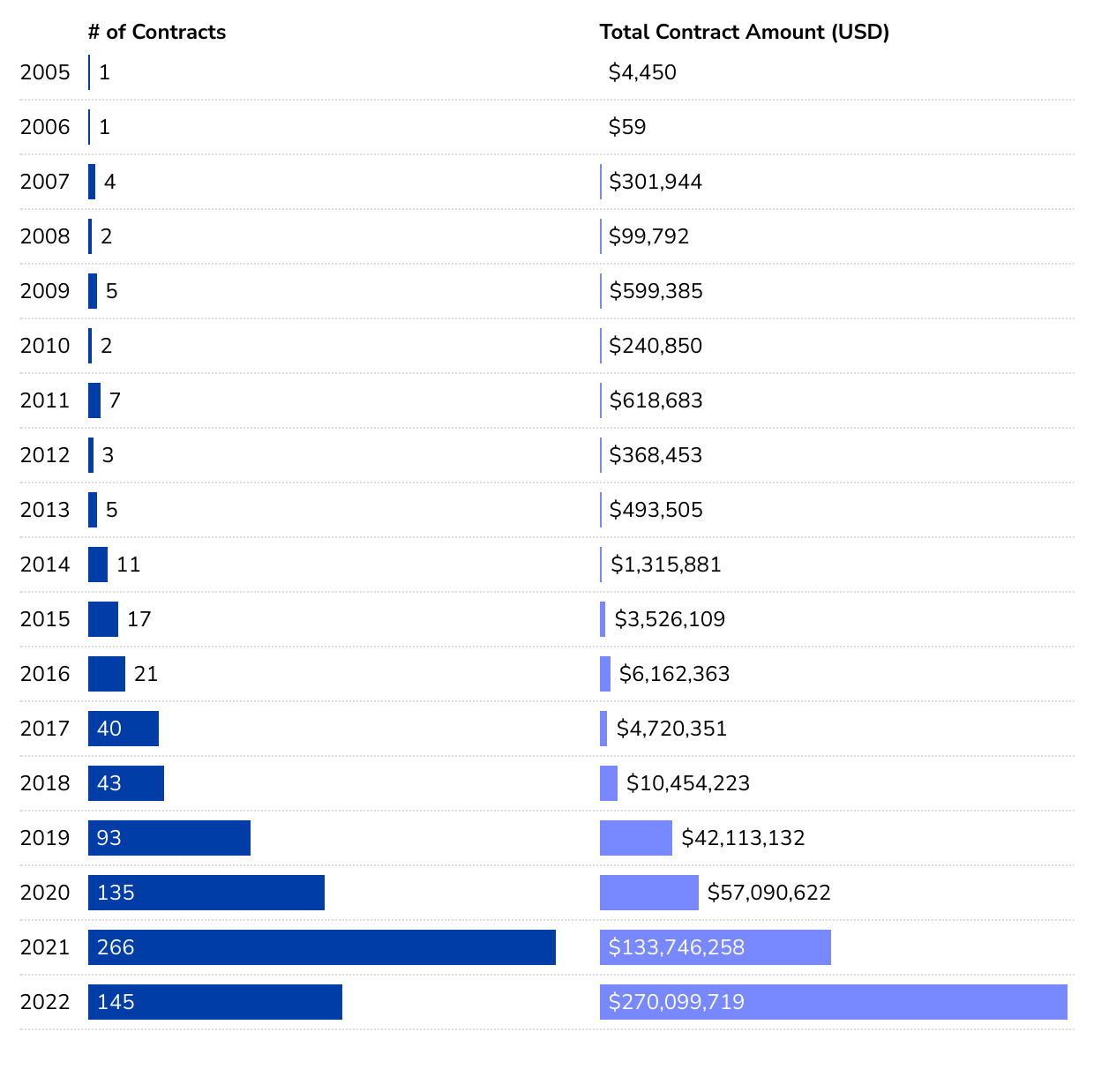

Procurement data also provides insight into which vendors show up the most within the contracted AI/ML space. Within our dataset, ECS Federal, Inc.—a service provider focusing on cloud, cybersecurity, AI/ML, and data—has received the most contracted amount for AI/ML services since 2005, with more than $78 million awarded over four contracts.

Figure 2: Top 10 AI/ML Vendors by Total Contracted Amount

Corporate Activity in Government Procurement

Industry players play an important role in government procurement, particularly in emerging technology fields like AI and ML. One recent example comes from the Department of Defense’s decision to award a $9 billion cloud computing contract amongst Google, Oracle, Microsoft, and Amazon. The Joint Warfighter Cloud Capability contract requires expertise in not just cloud computing but also data storage and security, so only the most established of industry players can adequately provide the desired services. Additionally, receiving the contract effectively serves as a stamp of approval from the U.S. government in an industry which values data security extremely highly. Given no other government-provided approval processes exist for data security (or most other emerging technology fields), these contracts are highly coveted. We look at two cases of industry representation in government procurement: Microsoft and DataRobot. Microsoft offers insight as to how larger companies contribute to government procurement, while DataRobot showcases how smaller, newer technology companies get involved.

Microsoft Azure

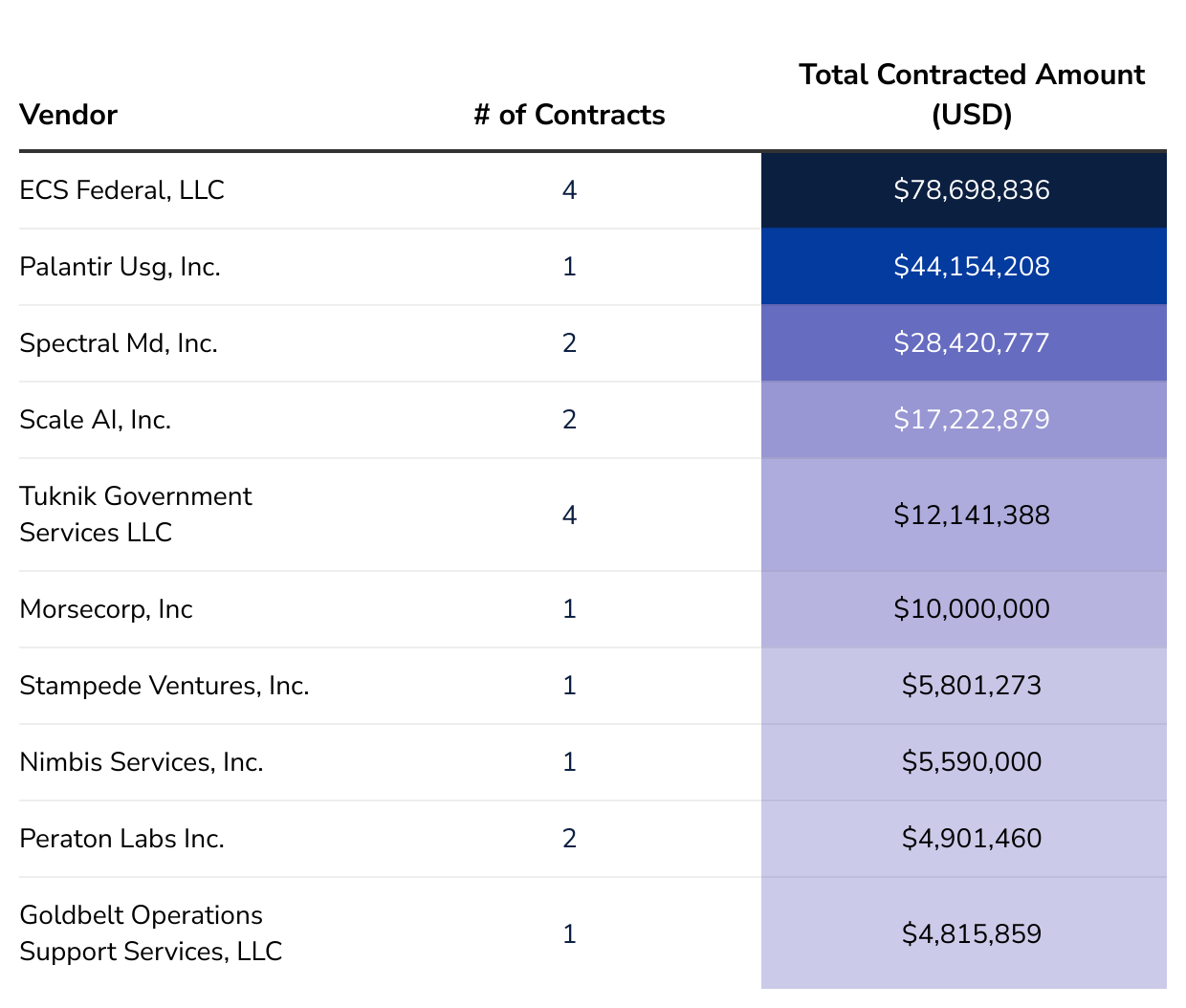

One example of a company utilizing government procurement in key emerging fields is Microsoft’s Azure platform. Launched in 2016, Azure was one of the first cloud-based machine learning services. Azure integrates data storage with machine learning tools, and supports end-to-end development through training, deployment, and monitoring. Microsoft markets AI and ML services, compute resources, app development, cross-cloud infrastructure, and Internet of Things integration. As part of Microsoft’s partnership with OpenAI, Azure also offers integration of ChatGPT and other generative modeling capabilities for users. Their client portfolio includes the NBA, H&R Block, and Fujitsu. Government agencies looking to leverage the cloud-computing landscape can utilize a pre-built platform like Azure without needing to develop in-house applications. For contracting purposes, Azure does not have to be solely supplied by Microsoft—any contractor can use the cloud-computing platform to fulfill contract requirements. This provides additional utility to both government agencies and contractors as any cloud-computing experts can leverage this system for public sector work. Microsoft benefits by increasing its client portfolio, gaining government trust, and optimizing the product for various data needs. Within the total collection of contracts, 827 contracts mention Microsoft’s Azure platform within the contract’s title or description.2

Figure 3: Distribution of Microsoft Azure Contracts and Their Contracted Amounts

DataRobot

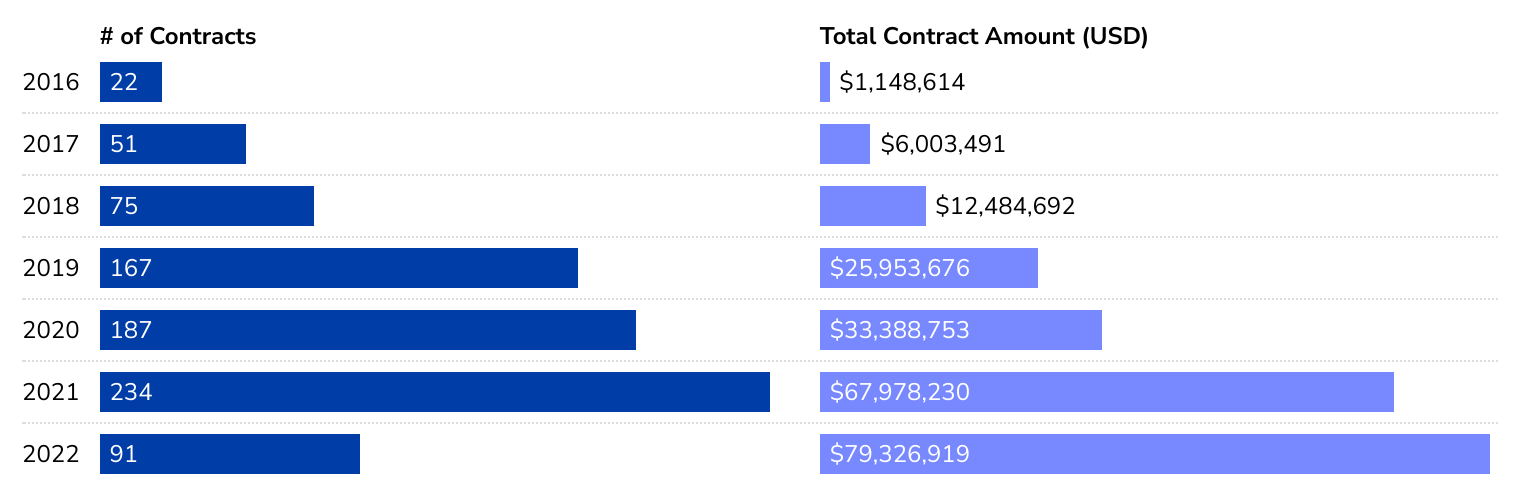

Integrated AI platforms exist beyond the realm of the large technology players like Microsoft and Google. Smaller, specialized companies offer unique approaches to full lifecycle AI/ML projects. DataRobot provides one such platform, marketed as “the only full-lifecycle AI platform that has broad ecosystem interoperability and a world-class team of applied AI experts to help you envision what’s possible with AI, and achieve it.” Responsible AI/ML has become a critical aspect to the field in recent years as relevant stakeholders grapple with the ethics of these new technologies. Large players like Microsoft and Google offer monitoring tools for deployed AI/ML systems within their platforms, but primarily focus on the entire development cycle. DataRobot’s platform markets integrated testing, validation, documentation, modeling, deployment, monitoring, and governance within an integrated platform. Its customizable UI ensures ease of access to all of these steps for all concerned parties, from data provider to model governors. For contracting purposes, DataRobot provides a competitive advantage by offering implementable responsible AI tools through its platform. Within the total collection of contracts, 54 contracts come specifically from DataRobot as a vendor.

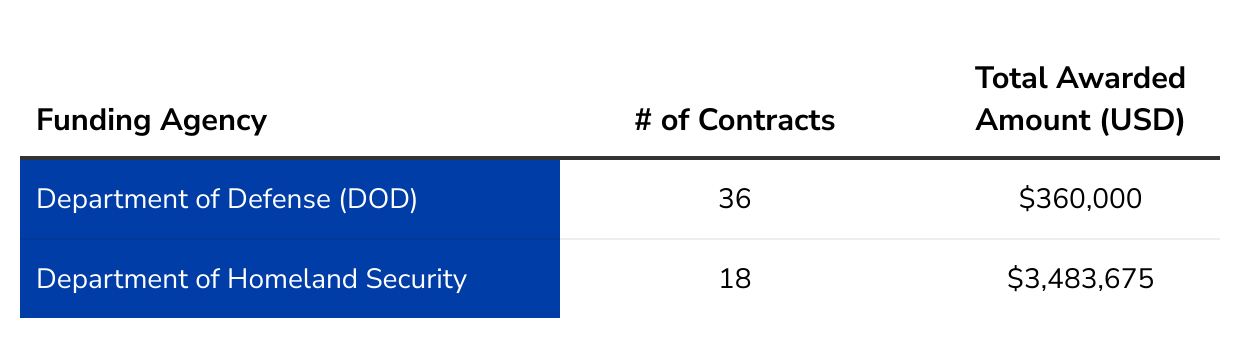

These 54 contracts come from only two federal agencies: the Department of Defense (DOD) and the Department of Homeland Security (DHS). DHS outspends the DOD by a factor of seven; however, the DOD contracts are more likely to not report a payment amount. Figure 5 shows the total number of contracts awarded by each agency along with the agency’s total disclosed awarded amount. While DHS reports a higher total contracted value, the DOD has twice as many total contracts with DataRobot.

Figure 4: Agencies Contracting DataRobot Services

Conclusion

Government procurement offers a lens into the federal government’s involvement with key technology areas. By tracking which technologies agencies seek from industry, researchers can learn about the state of federal technology adoption. This sample of contract data shows how federal agencies have drawn upon industry for key technology areas, and how industry members get involved with procurement. Further analysis into the key terms and phrases contained within the contract title and descriptions can provide more granular analysis of federal procurement.