This is the first installment of a three-part data snapshot series. Read Part 2 & Part 3.

Over the last two years, the rapid advancement of generative artificial intelligence tools has sparked a society-wide debate about how to govern this transformative technology. One major concern is that today’s leading tech companies will wield their existing economic power to dominate the market for AI systems. In July, authorities in the United States and Europe released a joint statement calling out the risks of incumbent firms “entrenching or extending their market power in AI-related markets,” and the U.S. Federal Trade Commission recently solicited research on the ways vertical business integration across the AI tech stack can impact innovation and competition. These concerns might be justified—a growing body of research has highlighted the ways that large digital platforms can leverage their existing assets to entrench their position in the AI market and undermine potential competitors. In this series of data snapshots, we explore three distinct but interrelated strategies: building cloud computing infrastructure, developing open-source software, and investing in startups.

Our analyses focus on the behavior of three U.S. companies—Alphabet, Amazon, and Microsoft. These firms, which we call the “Big Three,” dominate the global cloud computing industry, collectively controlling two-thirds of the more than $300 billion global cloud computing market, and have used that position to make aggressive pushes into the AI market. Computing resources are an essential input for many digital services, from AI tools to public websites. As countries around the globe look to adopt new technologies and increase their footprint in the digital economy, the Big Three are leveraging their dominance in the cloud computing market to position themselves as essential infrastructure for companies, developers, and government agencies.

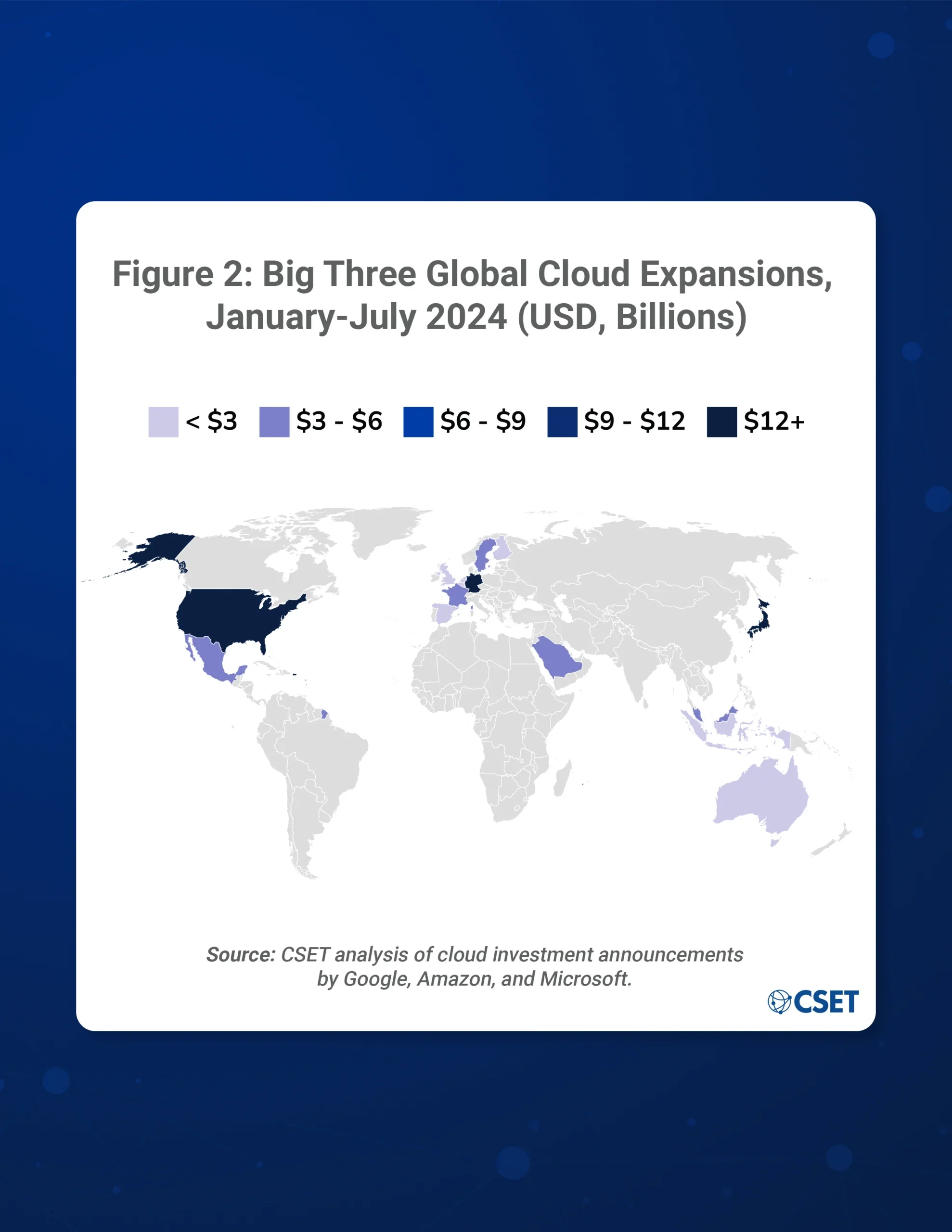

To understand how the Big Three are expanding their global presence, we collected information on their investments in cloud computing infrastructure. A review of company websites and news outlets revealed that between January and July 2024, Amazon, Google, and Microsoft announced 21 investments across 15 countries for a total of $130 billion. As shown in Figure 1, Amazon accounted for the majority of the total spending in this period.

Figure 1: Big Three Cloud Infrastructure Investments, January-July 2024

These investments make sense from a business perspective. The global demand for cloud services is growing rapidly, and infrastructure expansion allows the Big Three to accommodate more customers and drive up revenue. However, when viewed through the lens of market competition, these investments may have harmful effects, such as locking customers into providers’ technology ecosystems and making it harder for new companies to gain a foothold in the market. Examining the geographic distribution of these investments can offer insights into the factors driving these companies’ global investment strategies.

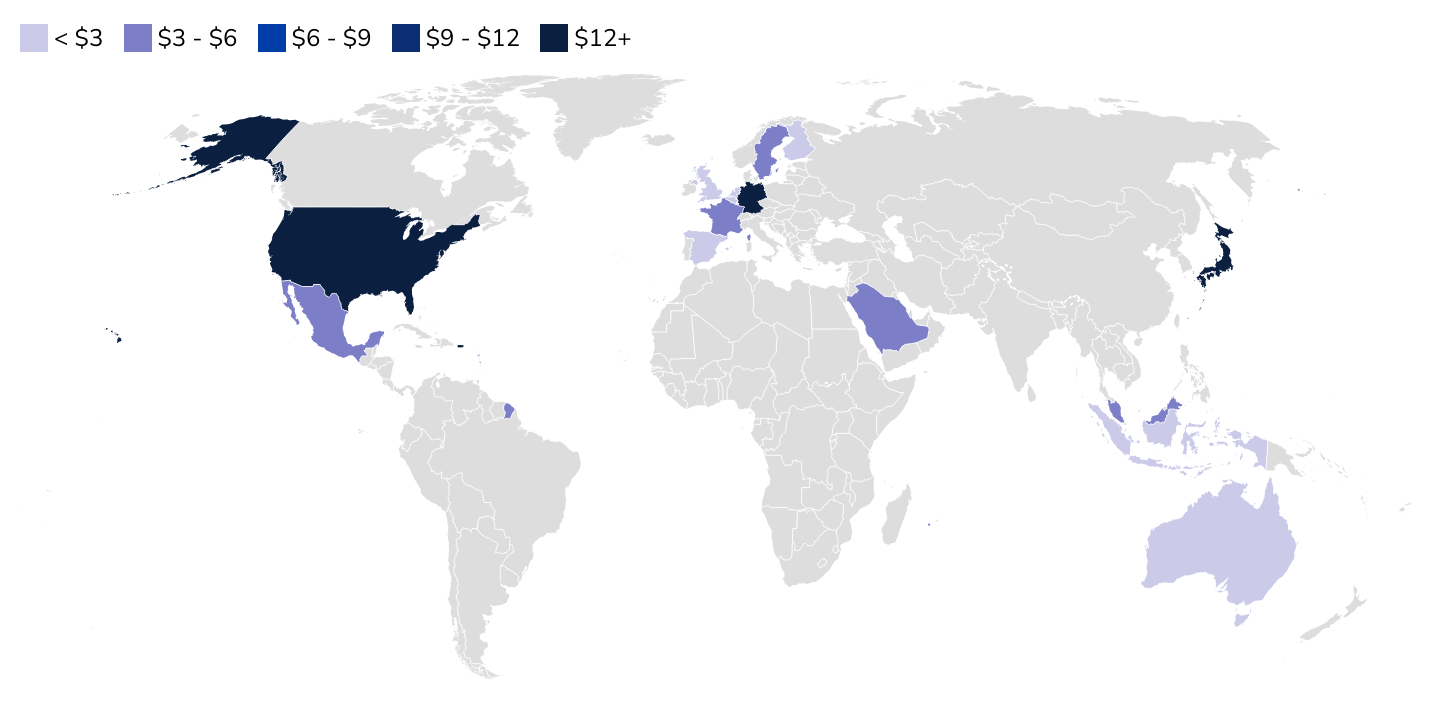

Our analysis indicates that the Big Three are making substantial cloud computing investments in both developed countries and key emerging markets, as shown in Figure 2. The Big Three have continued to prioritize investment in North America, with Amazon pouring $35 billion into a multi-decade buildout of data centers in Virginia and $5 billion into infrastructure expansions in Mexico. The Big Three have also made substantial investments in the European Union, with Germany, France, Spain, Belgium, the Netherlands, Finland, Sweden, and the UK receiving a combined $37 billion in investment in the first seven months of 2024. The Big Three have also focused their attention on burgeoning tech economies in Southeast Asia. For instance, Microsoft invested $2.2 billion in Malaysia to build cloud infrastructure, expand AI services, and grow the country’s tech workforce. Microsoft also invested $1.7 billion into Indonesia for cloud infrastructure and AI services.

Some investments appear to be motivated by broader geopolitical trends. Japan, for instance, is in the midst of a wide-scale modernization of its economy, civil infrastructure, and military, and the Big Three companies have invested nearly $18 billion into the country for cloud infrastructure to service anticipated demand from the private and public sectors. Amazon is also set to invest over $5 billion in Saudi Arabia, a country where both the United States and China are battling for influence. The Big Three, alongside the U.S. government, have used cloud infrastructure investments as a way to garner positive relations in the Gulf in the past.

Figure 2: Big Three Global Cloud Expansions, January-July 2024 (USD, Billions)

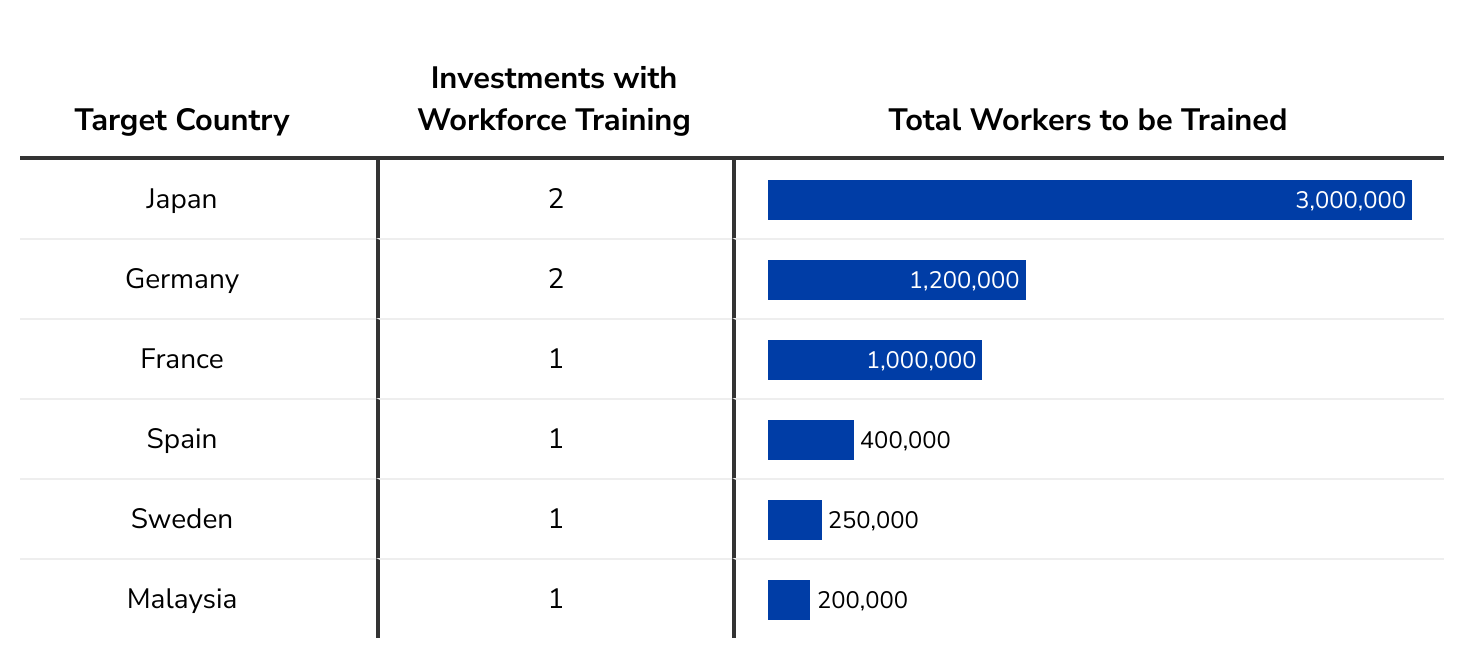

In addition to cloud infrastructure, Alphabet, Amazon, and Microsoft also invest in global workforce-development programs. By coupling the infrastructure investments with workforce development, the Big Three are able to create compute capacity in key geographic areas and foster demand for the services they plan to provide. This twofold investment creates a direct linkage between the emerging technology workforce and the company’s suite of tools. Often, the Big Three target countries with underdeveloped or no existing cloud infrastructure, a strategy that runs the risk of creating a monopoly for cloud computing services across the public and private sectors. For example, Microsoft’s $2.9 billion investment in Japan includes a promise of training 3 million people, with the stated goal of “advanc(ing) the societal benefits offered by AI through companies of all sizes, governments, and public entities – including the Tokyo Metropolitan Government.”

Of the Big Three’s 21 deals announced between January and July 2024, 16 (76%) include funding for workforce development, with at least 8.25 million workers set to be affected by the programs—the equivalent of training the entirety of New York City. As with infrastructure expansions, these workforce-development programs can benefit both the cloud provider and the participants in the program, though they may have negative effects on competition in the cloud market. Because companies tailor these workforce-development programs to their specific suites of cloud and AI services, these initiatives can serve to lock participants into a particular cloud provider’s ecosystem. These programs are similar to the courses the Big Three offer related to their platforms, such as the AWS Certified Developer course, which builds competencies not in cloud computing as a whole but rather AWS’ specific offerings.

Figure 3: Big Three–Announced Workforce Training Investments in Select Countries, January-July 2024

The effects of joint infrastructure and workforce investments will not be seen immediately, but the Big Three have devoted the resources to create global capacity and demand. Governments in these countries may not have the regulatory resources to police these cloud providers nor sufficient existing competitors to shape the market, but still have an outsized need of the services cloud providers offer. Within these countries, the first cloud provider that is able to both build sufficient cloud infrastructure and create demand through workforce training has the potential to reap all of the rewards.