Introduction

Government contracts play a critical role in connecting agencies with key services and technologies. By requesting proposals, examining bids, and awarding contracts, government agencies procure all types of goods and services from a variety of suppliers. These contracts represent major opportunities for businesses looking to work with the U.S. Government—in fiscal year 2021, the federal government spent approximately $637 billion on contracts alone. According to a 2021 White House memo, the federal government is “the largest purchaser of goods and services in the world.” The contracting process entices large industry players through lucrative contract opportunities, and provides support for equitable industry access through a variety of small-business set-asides and joint ventures. Set-asides limit contract bids to only those companies that fit certain criteria, including small business, 8(a) business development, HUBzone, woman-owned, and service-disabled veteran-owned. Joint ventures allow smaller companies to offer competitive bids either by pooling resources or by filing with a larger, “mentor” company.

Contracts, unlike other federal funding opportunities, pertain to the procurement of property or services that directly benefit the U.S. government and require private sector support to implement efficiently. In recent years, key emerging technology fields have been a critical area in which government agencies utilize the procurement process. In February 2022, the Department of Defense stood up the Chief Digital and Artificial Intelligence Office (CDAO) by merging the Joint Artificial Intelligence Center (JAIC), Defense Digital Services (DDS), the Chief Data Officer, and the DOD’s advanced analytics platform, Advana, into one office. The CDAO seeks to ease the integration of key data pipelines and artificial intelligence (AI) systems into the DOD’s operations by utilizing rapid-procurement contracts. One recent example is the JAIC’s blanket purchase agreement to 79 industry vendors for AI test and evaluation systems. This integration of critical technology into government operations through contracts provides researchers with an opportunity to track which technology areas garner the most interest from government agencies.

While the U.S. government offers access to procurement data through various websites, aggregating and cleaning this data requires substantial investment. The government procurement bid process involves several stages of solicitation and downselection before a contract is awarded, resulting in multiple records containing unique information. Solicitation refers to any process in which the government seeks insight from private industry, and includes requests for information (RFI), requests for proposals (RFP), and requests for quotation (RFQ). Each of these solicitation methods have different goals. For example, RFIs allow the contracting agency to clarify specifications outlined within a potential contract, although a contract may never end up being offered following an RFI. Additionally, contract data is not uniform across agencies nor across applications. Reporting requirements vary depending on the agency and the good/service rendered.

Analysis of government procurement requires an understanding of each stage of the contract process. Several commercial entities tackle this problem to provide actionable intelligence into the government technology space. One such company is Govini, which CSET partnered with for an exploratory research project looking for subsets of AI-related contracts.1 This data snapshot utilizes curated contract data from Govini’s Ark.ai platform to show how contract analysis provides insight into key emerging technologies. Specifically, we utilize strict text matching to identify three key technology areas in awarded contracts: “Automated Generation,” “Low-Code Systems,” and “No-Code Systems.” Systems utilizing these technologies reduce the skill and time requirements for software development, so they are important for making development more accessible to federal agencies. Identifying relevant contracts from U.S. government procurement data is challenging as key technology areas often cut across industry classification codes and require expert analysis to ensure their relevance. These areas often see shifts in terminology or key phrases as the field develops. For these reasons, the results presented here should be considered preliminary.

Automated Generation

“Automated Generation” refers to software applications that automatically parse, analyze, and/or develop data systems for downstream use.2 These applications seek to reduce the amount of human effort required to develop testable systems at a fraction of the cost. Within our procurement dataset, 17 contracts explicitly mention automated generation systems.

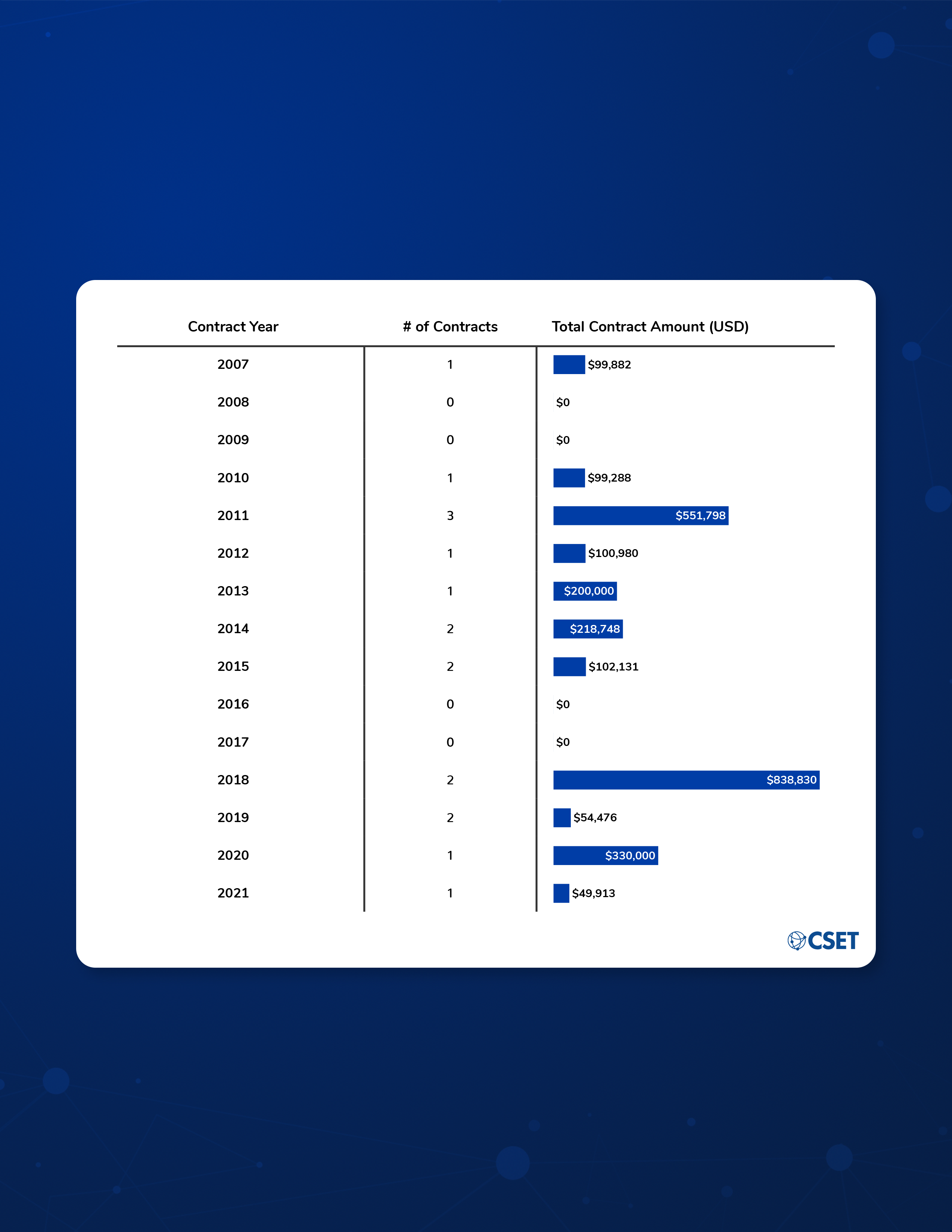

Figure 1. Distribution of Automated-Generation Contracts and Their Contracted Amounts

Of the three technologies covered, automated generation has the longest history within government procurement. 2011 and 2018 stand out as years with increased contracted spending. Eleven distinct vendors across nine states fulfill these 17 contracts.

Low-Code

“Low-Code” refers to systems that seek to shift the software development cycle from a technical environment to a user-friendly interface while maintaining some programming aspects. Given the technical complexity of modern programming systems, low-code systems make programming more accessible to the existing workforce by reducing the technical barrier to entry. This reduction in the technical barrier allows agencies to leverage their existing domain expertise into the created system, resulting in an expedited development and deployment timeline. Within our procurement dataset, 20 contracts explicitly mention low-code systems.

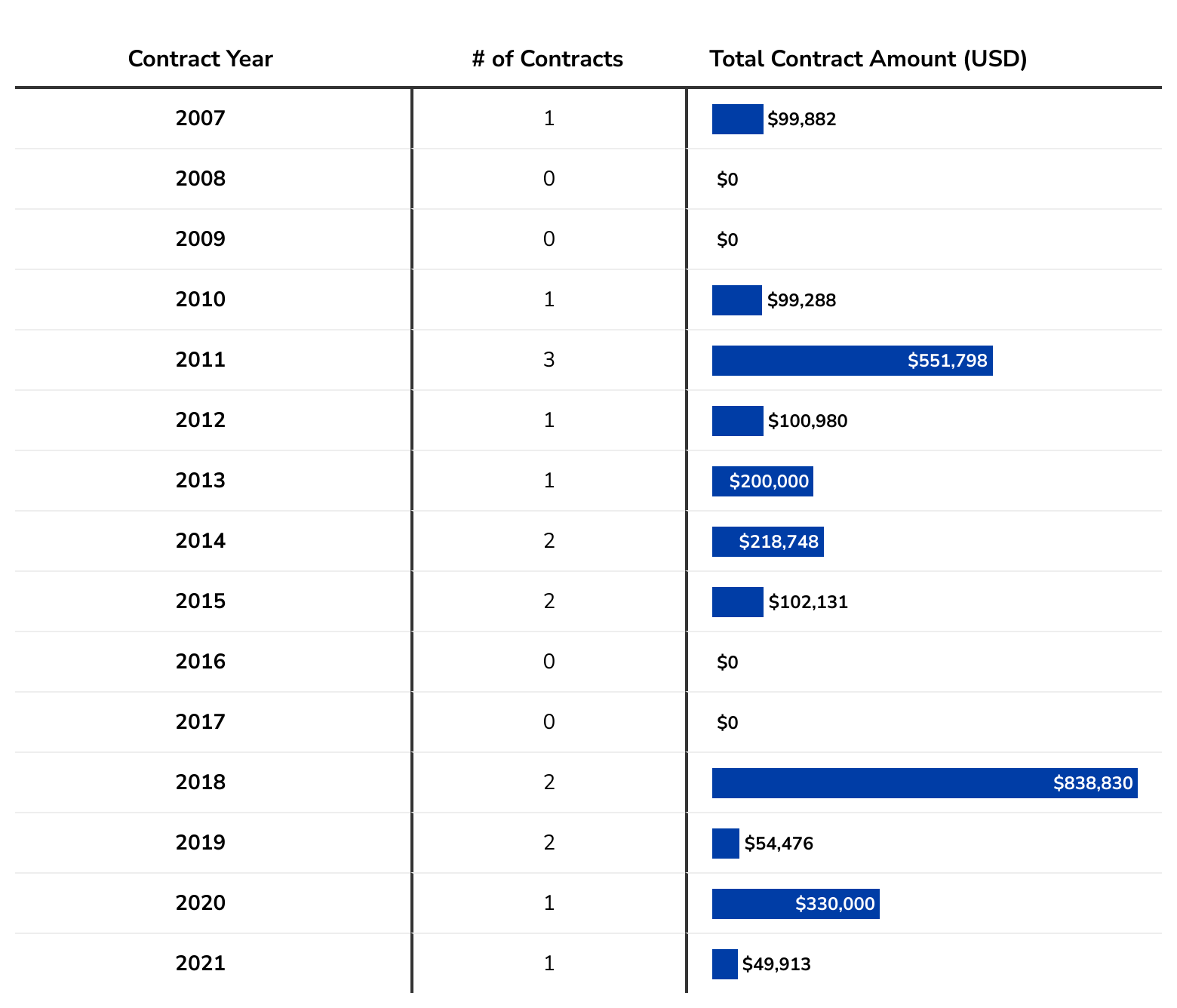

Figure 2. Distribution of Low-Code Contracts and Their Contracted Amounts

Within our dataset, low-code systems are the newest of the three technologies covered in terms of government procurement, though this may be an artifact of the data collection process. With major activity starting in 2020, low-code work has seen the largest increase in interest from federal agencies in recent years, as evidenced by $11.5 million dollars in procurement in 2022. Fifteen distinct vendors across six states fulfill these 20 contracts.

No-Code

“No-code” systems are similar to low-code systems in that they seek to reduce the technical barrier to programming; however, no-code systems do so in an entirely visual way. A user must only provide the required logic for the system to generate the necessary software, without any input needed from an IT professional. These systems aim to provide rapid delivery of software systems. Within our procurement dataset, 15 contracts explicitly mention no-code systems.

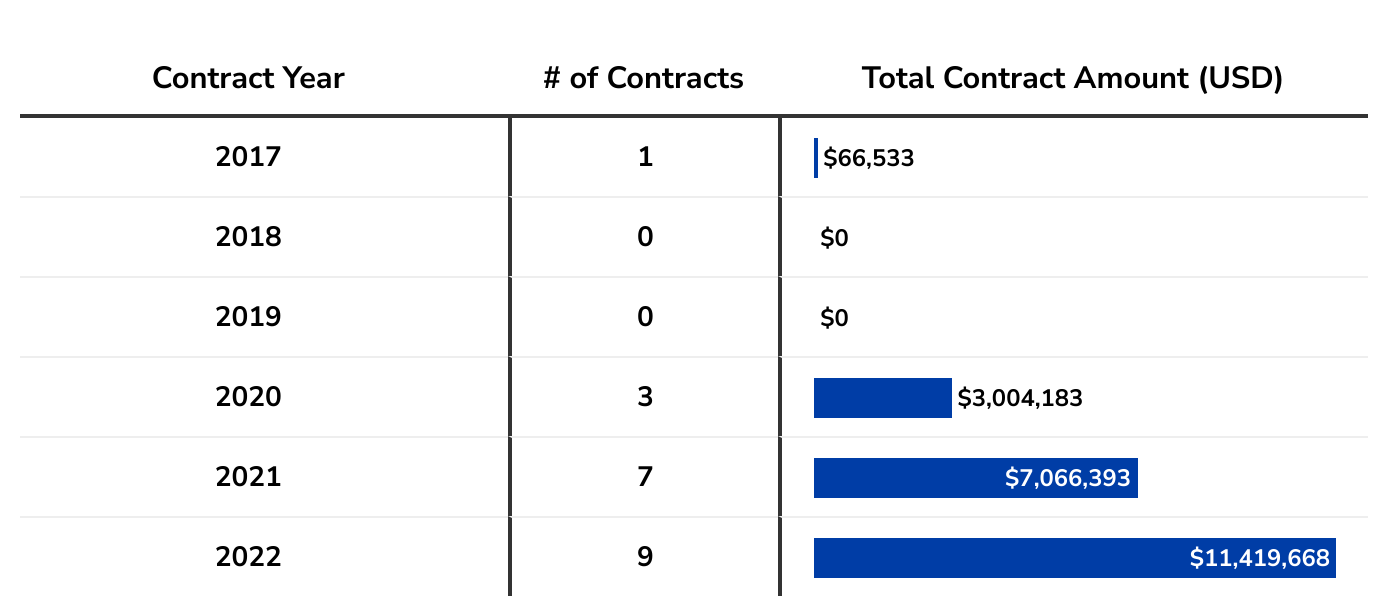

Figure 3. Distribution of No Code Contracts and Their Contracted Amounts

No-code systems saw the most procurement contract activity from 2014-2016. However, the recent contract in 2022 had the highest dollar figure attached relative to the other years. Twelve distinct vendors across 10 states fulfill these 15 contracts.

Conclusion

Government procurement offers a lens into the federal government’s activity in key technology areas. By tracking which technologies agencies seek from industry, researchers can draw conclusions about the state of federal technology adoption. This sample of contract data shows how federal agencies have drawn upon the key areas of automated generation, and low- and no-code systems. Further analysis into the key terms and phrases contained within the contract title and descriptions can provide more granular analysis of federal procurement. The next snapshot in this series will dive into key industry players present within government procurement by searching for their provided platforms.

The second blog post in this series can be found here.

- No money was exchanged for this research agreement, and this is not an endorsement or advertisement for Govini’s services.

- Automated generation systems are distinct from generative AI systems. Generative AI systems create some final output, whereas automated generation systems cover the development and production of systems.