What’s New: A new report by the Center for Security and Emerging Technology (CSET) maps how the globe’s top 50 defense companies are approaching artificial intelligence (AI).

Why This Matters: Oddly,it appears very few of these companies are investing in or acquiring private AI companies — neglecting a critical pathway to private sector expertise and capabilities.

Key Points:

- AI is an essential dual-use technology — capable of broad economic, social, and military applications.

- While some of the most pioneering AI work is being done by the tech titans like Google, Facebook, and Microsoft, there are thousands of smaller companies who are doing novel and important AI research and application.

- Defense companies seeking to leverage AI for themselves and for their clients essentially have three ways of getting AI expertise and capabilities: in-house R&D, research partnerships with R&D programs at outside institutes and universities, and investments and mergers and acquisitions (M&A).

- In-house R&D is very expensive and puts defense contractors in direct competition for talent with the world’s most wealthy, innovative, and agile tech leaders — typically not a winning strategy.

- Outside partnerships are important, but can be slow and do not always result in broad, commercial applications.

- Investing in and acquiring private AI companies, on the other hand, can be an efficient way for defense companies to build their expertise, talent base, and commercial products. This can also be a type of “bridge” between the private sector and the government.

- But most of the world’s top 50 defense contractors, according the CSET analysis, are not meaningfully investing in or acquiring private AI companies.

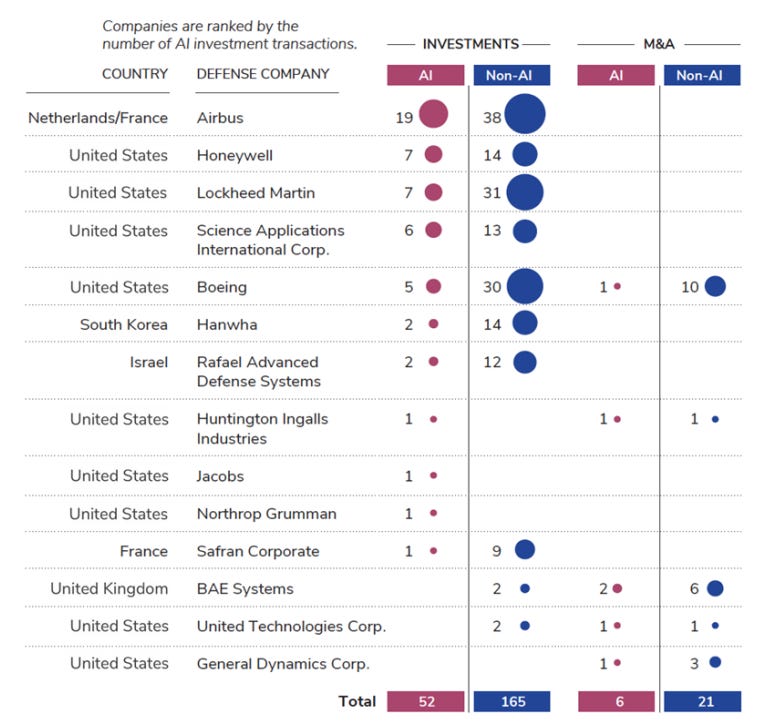

Total Top Global Defense Company AI and Non-AI Investment and Mergers & Acquisitions (M&A), 2013-2020

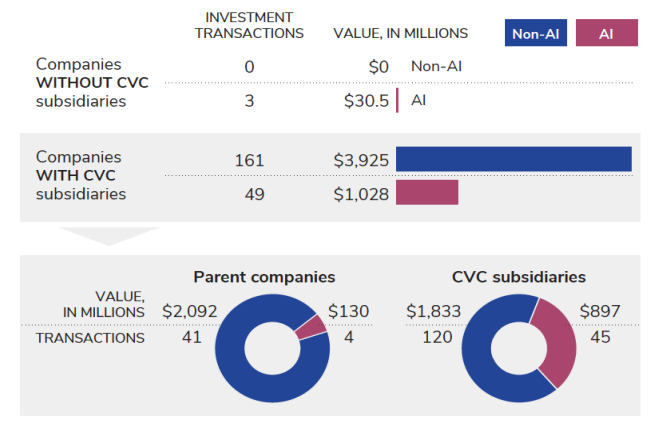

- Importantly, Defense companies that have a corporate venture capital (CVC) fund or subsidiary are far more likely to invest in AI companies.

Investments in AI and Non-AI by Eleven Defense Companies with and without Venture Capital Subsidiaries (CVC), 2013-2020

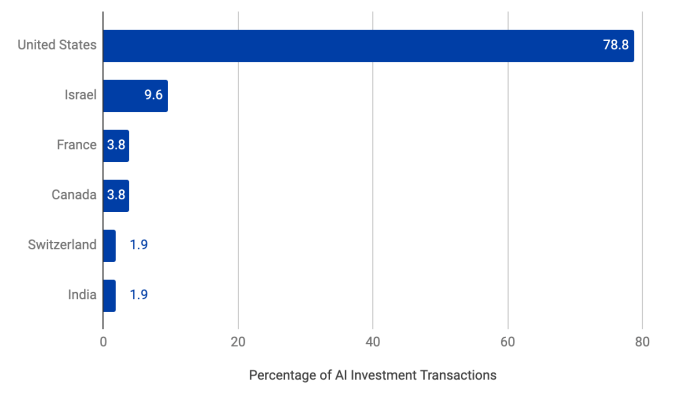

- Finally, U.S.-based AI companies were the ones most likely to receive investments or to be acquired.

U.S.-based AI Companies are the Top 50 Global Defense Companies’ Primary AI Investment Targets, 2013-2020

What I’m Thinking:

I’ll let CSET take it from here.

“The findings presented in this paper suggest that there is little AI investment and M&A activity initiated by the largest global defense companies since the major AI/ML [artificial intelligence/machine learning] breakthroughs in late 2012. It is important to understand that the lack of dependency on investment and M&A to access commercial AI technology is not equivalent to the absence of AI capabilities and capacity within the major defense companies. It is possible that major global defense companies are accessing AI either using subcontract relationships on a project-by-project basis or by developing integrated AI internally. It is also possible that major global defense companies may not believe AI is mature enough for integration into embedded systems and products at this point, or that defense company investors are perhaps not ready to tolerate the risk and uncertainty of investment returns associated with emerging technologies and early-stage investment.”